The financing landscape for life sciences issuers has transformed over the last 5 years. In this three-part series, we will cover 1) the evolution of the typical life sciences IPO, 2) post-IPO financing dynamics and the importance of laying the foundation for successful capital raises, and 3) later stage financing considerations and the path to issuing convertible debt.

The Evolution of the Typical Life Sciences IPO

The life sciences IPO playbook was historically: 1) secure venture funding over a few rounds of financing, 2) strike a partnership deal, 3) advance your asset(s) to late stage (phase 2/3 or beyond), 4) take the company public in an often highly dilutive IPO, and 5) in many cases, struggle to raise capital in the public market to fund development and alleviate a financing overhang over time.

The life sciences IPO market, particularly for biotech, has evolved to be incredibly robust over the last 5 years. Factors driving this include:

- Introduction of the Jobs Act in 2012 and Testing the Waters (“TTW”) dynamics

- “Crossover” rounds are now part of the playbook

- Increase in capital / number of dedicated venture funds focused on the sector

- Dramatic increase in investor appetite for early-stage assets

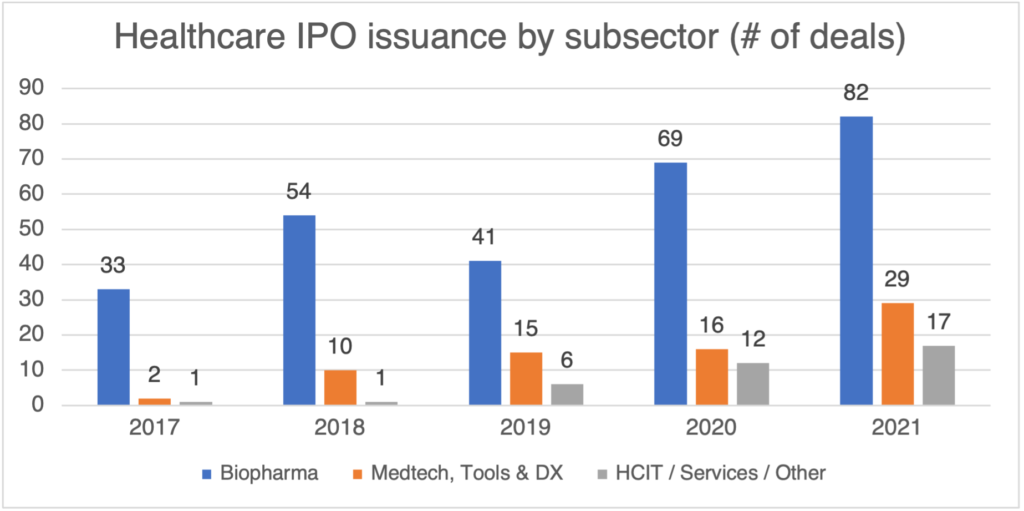

Over the last 5 years there has been ~$90bn of healthcare IPO issuance across ~390 IPOs1, which represents 40-50% of the overall IPO calendar across all sectors by deal count on any given year. Biopharma has accounted for a significant portion of the deal volume with 279 IPOs or ~72% on a deal count basis. Medtech / tools & DX volume has seen an uptick over the last few years (29 IPOs in 2021, 16 IPOs in 2020, and 15 IPOs in 2019, compared to 10 IPOs in 2018 and just 2 in 2017) on the back of innovation in the diagnostics space (especially cancer diagnostics) along with a resurgence of high-growth non-DX medtech IPOs to the deal calendar. Healthcare IT / Services has also seen a steady uptick in IPO volume as the digital health landscape continues to evolve. All issuers have benefited from a huge influx of capital to the private market, creating more de-risked IPOs as investors continue to chase alpha by investing pre-IPO.

Introduction of the Jobs Act in 2012 and TTW Dynamics

The introduction of the JOBS Act in 2012 provided significant benefits for companies pursuing an IPO, with the following as the most critical from a marketing standpoint: 1) the implementation of Testing the Waters meetings and 2) the ability to file the initial S-1 confidentially for review with the SEC.

The TTW exercise has evolved over the years as banks and law firms refined their internal legal and marketing views around the process. In early TTW exercises, market practice was to limit the outreach to 10-15 institutional investor accounts to keep the process tight and avoid the appearance of pre-selling an IPO before public marketing (soliciting IPO orders is not permitted as part of TTW). This limited the audience of investors from which issuers could garner true qualitative and quantitative feedback.

TTW now often includes 50+ institutional accounts, which creates more depth in the feedback loop and increases an issuer’s comfort with proceeding with the public IPO filing. With compressed IPO execution timelines, coupled with high issuance levels, many investors look to the TTW meetings as their chance to begin diligence on a company as the IPO meeting itself is more confirmatory in nature. Additionally, pre-TTW IR strategy (inclusive of marketing a crossover financing) has become more important than ever before.

Before the introduction of the JOBS Act, an issuer submitted its initial S-1 filing publicly, signaling to the world that the company was pursuing an IPO. The initial filing was followed by a 30-day SEC review period, then typically multiple rounds of comments before the company was able to launch the IPO roadshow. If there was a company specific event that delayed the IPO roadshow or if the market turned negative during that period, an issuer would be forced to “withdraw” the IPO filing. This, in turn, created an unfavorable cloud of speculation around the company in the market.

Following the JOBS Act, issuers can file / go through the SEC review process confidentially while simultaneously conducting TTW meetings and publicly filing 15 days before the launch of the anticipated IPO roadshow. The ability to submit the initial S-1 filing and respond to comments confidentially has enabled issuers to work through most of the IPO process without having the scrutiny of the public market on the company. This provides issuers more flexibility to “flip” publicly or walk-away from an IPO process in the shadows.

Take-away: The TTW process is a critical step in the IPO process. In selecting its banking syndicate, issuers must have confidence that the banks’ Equity Capital Markets teams will attract the appropriate mix of institutional accounts and push for real, tangible investor feedback throughout the TTW process.

“Crossover” Rounds Are Now Part of the Playbook

“Crossover” investment, where more traditional IPO investors buy into pre-IPO rounds of financing, has redefined the execution of the life sciences IPO over the past 5 years. In fact, the pre-IPO crossover financing is now essentially part of the IPO process. While crossover investment did exist before the JOBS act, it was infrequent and the depth of the investor universe / amount of capital dedicated to the exercise was far less. Investors’ desire to gain exposure to pre-IPO companies at a lower cost basis and secure a larger IPO allocation is what ultimately drove the growth in the crossover market. Elevated appetite for private paper, coupled with more capital being deployed, has led to larger crossover rounds, which have gradually grown from $50-75mm to now often $75-150mm+. The result is stronger balance sheets with longer cash runways at IPO, which bodes well for deal execution.

The presence of crossover investors (both long-only mutual funds and sector dedicated funds) provides considerable benefits to an issuer pursuing an IPO. A successfully executed crossover financing provides an opportunity to conduct a pre-IPO IR campaign in advance of any TTW / IPO process. The ability to transition / reposition the shareholder base from venture / early stage to a more institutional profile is a major benefit and provides a de-risking element to the IPO through “built in support” from these investors for the deal.

This support is important because the syndicate will look for a certain amount of “coverage at a launch” to feel comfortable proceeding with the public launch of the IPO. The desired level of “coverage at launch” depends on several factors: quality of pre-IPO shareholder base, TTW feedback, market backdrop, etc. Overall, having the deal 1x covered from existing investors tends to be the “magic number.”

The crossover round also serves an important purpose in setting the IPO valuation. The “step-up” at IPO (pre-money valuation at IPO / post-money valuation of last private financing) is front of mind for investment bankers and investors alike. It is used as a metric to inform the price range for the deal alongside other inputs (probability weighted DCF, discount to comparable companies, etc.). The step-up metric has evolved from being largely an output to an input with respect to triangulating on value, and we have seen a convergence at ~1.2-1.5x in a normalized market, with outliers in both directions. Factors such as IPO proximity to crossover financing, de-risking company specific milestones / news flow between crossover and IPO, IPO “setup” (insider demand) and broader IPO market sentiment all play a big role in what valuation ultimately is achieved at IPO.

Take-away: The crossover financing is a critical piece of the IPO process, and if done correctly, can set a company up for a successful IPO execution even in a challenged market backdrop. It is important to recognize that the market will focus on step-up to the last round (at a minimum as a sanity check), so achieving the right valuation in a crossover financing is critical. For some companies, engaging an advisor to run a robust process may prove beneficial in delivering a strong outcome.

Increase in Capital / Number of Dedicated Venture Funds Focused on the Sector

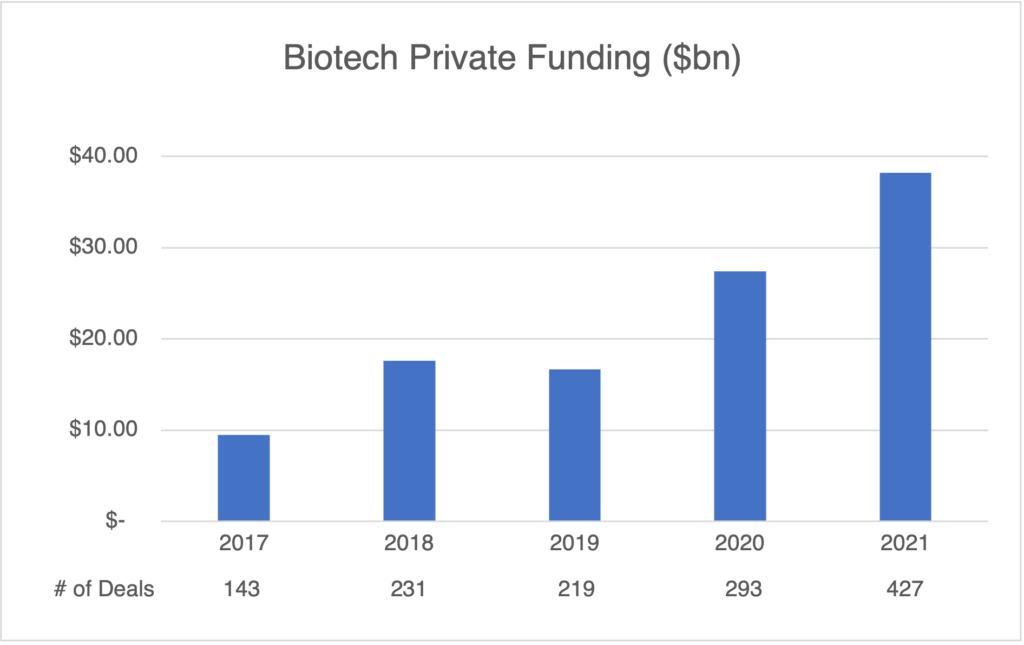

The amount of funding deployed both privately and publicly across life sciences has grown dramatically over the past decade. Access to capital has never been so robust. In 2017, there were 143 biopharma private capital raises totaling ~$9bn vs. 427 totaling ~$38bn in 2021. The IPO volume over the same period has more than doubled, with 33 biopharma IPOs in 2017 vs. 82 in 20212.

Life sciences VC fundraising eclipsed $28bn in 2020, up nearly 100% from 2019’s record of ~$14bn (vs. ~$9bn in 2017). In 2021, ~$82bn of capital was raised for biopharma companies across private financing and public deals (IPO, follow-on, convertibles, PIPES) and interestingly, the split between public and private capital raised was approximately 50/50% as the push towards private strategies continues.

The number of dedicated life sciences VC funds has grown along with the amount of funding raised. Many “public market” investors have also developed crossover strategies that focus on company formation / earlier stage investment vs. later stage pre-IPO financings, further adding to the pool of early-stage capital.

Take-away: Not all capital is created equal. It is important for issuers to thoughtfully curate the investor syndicate in earlier stage financings. Some investors take a hands-on / operational role, some play outsized roles in future financings, some bring more visibility, and some traffic in alternative forms of capital beyond equity.

Appetite for Early-Stage Investments Has Increased Dramatically

A major factor driving the increased flow of capital to life sciences is innovation in areas such as gene therapy, gene editing, precision medicine, cell therapy, cancer diagnostics, and more recently, application of artificial intelligence / machine learning techniques. Much of this innovation skews towards earlier-stage assets / company profiles. While “ultra” early-stage assets tend to move in and out of favor depending on external factors such as M&A volumes, recent data readouts and sub-sector focus, the market receptivity for earlier stage IPOs has grown in recent years. In 2015, 40% of the IPO volume was late stage (phase 3 or beyond) vs. just 9% of the IPO volume in 2020 and 15% in 1H2021.

Take-away: Crossover dynamics and depth of the capital markets are key drivers in the shift along with broad appetite from generalist investors chasing alpha through the biotech IPO deal calendar. While earlier stage assets have been in favor, this tends to shift back in a more challenging market backdrop.

Conclusion

The IPO playbook has changed. This has consequences not only for the IPO process itself, but in the prior financing rounds. The path to IPO is not (and should not be) defined as “one size fits all” – each IPO is truly unique and faces its own challenges. Careful curation of investors in private financings, a strong crossover valuation that supports a digestible step-up into IPO, and a well-executed IPO process (including a strong TTW campaign), are all important pillars of a successful debut in the public market.

For detailed analysis and advice regarding your specific situation, please reach out to the Matthews South team.

1 Source: Dealogic, Bloomberg. Excludes IPOs less than $30mm as of 12/31/21.

2 Source: Pitchbook, public market filings. Includes all VC, Series and Growth Equity deals >$30mm.

Personal Views: The views expressed in this report reflect our personal views. This blog post is based on current public information that we consider reliable, but we do not represent it is accurate or complete, and it should not be relied on as such. The information, opinions, estimates and forecasts contained herein are as of the date hereof and are subject to change without prior notification. The large majority of reports by us are published at irregular intervals as appropriate in our judgment and ability to produce, so updates may not be made or available even when circumstances may have changed.

No Offer: This analysis is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. It does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. You must make an independent decision regarding investments or strategies mentioned on this website. Before acting on information on this website, you should consider whether it is suitable for your particular circumstances. You should not construe any of the material contained herein as business, financial, investment, hedging, trading, legal, regulatory, tax, or accounting advice. The price and value of investments referred to in this analysis and the income from them may fluctuate. Past performance is not a guide to future performance, future returns are not guaranteed, and a loss of original capital may occur.