As part of our market update series, please see the summary below of what we saw in the convertible market in Q1 2021.

We have previously discussed the new accounting standards from FASB governing convertible bonds and reviewed company disclosure around early adoption of those standards. In this post, we investigate whether the accounting change is changing the structuring of new convertible issuances.

Settlement Implication of ASU 2020-06. Under the new standards, an “in the money” share computation for computing the denominator of EPS will only apply to bonds that are structured to be Net-Share Settled (“NSS”): conversions are settled up to the principal amount in cash, with in-the-money value settled in shares. If bonds have Flexible Settlement (issuer may elect cash, shares or any combination upon conversion), the EPS denominator will assume full-share settlement.

Issuers with Flexible Settlement bonds previously could use the in-the-money share computation if they established an intent to net-share settle conversions; the vast majority of convertibles issued in the past few years were structured this way. With the new guidance, we anticipated that (1) issuers of new bonds would more frequently select the net share settlement option, and (2) issuers with existing flexible-settlement bonds would amend them to eliminate all the settlement choices besides net-shares.

We have observed both trends in 2021.

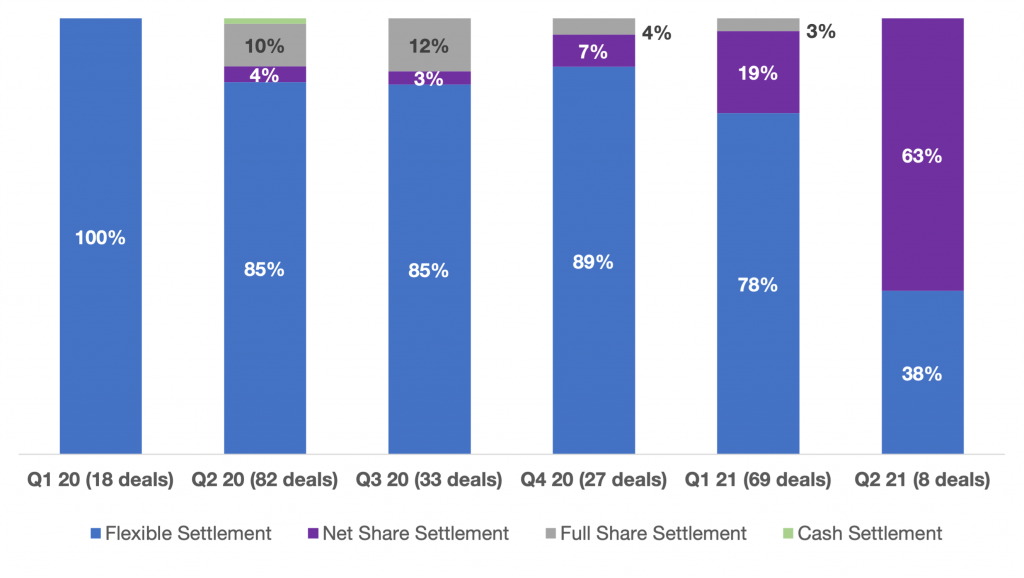

New Issue Trends. In 2020, new convertible bonds structurally tracked trends over the past few years — the vast majority (88%) had flexible settlement, with many issuers taking advantage of the net share intent language. Share-settled conversion was the second most common structure (8%), as companies in some sectors (e.g., biotech, REITs) view equitization of the balance sheet upon conversion as strategically valuable. Only a few deals each quarter were structured as true net share settlement. This was true even after August 2020, when the new FASB guidelines were published.

2021 has seen a shift towards NSS as companies either early adopt ASU 2020-06 or anticipate its adoption. Of the 16 issuers (18 bonds) who have issued NSS bonds, more than half have early adopted and more may disclose early adoption with Q1 filings.

Many 2021 convertibles were still structured with Flexible Settlement. Companies continue to value the balance sheet flexibility of not being forced to use cash to settle conversions (and many companies have not yet early adopted ASU 2020-06). Throughout the year and in 2022 when ASU 2020-06 becomes mandatory, we expect NSS to increase in market share but not become the default choice for all issuers as Flexible Settlement has been. Issuers will need to consider the relative value of settlement flexibility compared to the differential diluted share count impact of the two structures.

Irrevocable Election of Net Share Settlement. Most convertible indentures allow issuers to irrevocably elect to eliminate settlement alternatives. In this way, issuers can transform a Flexible Settlement bond into a NSS bond in anticipation of implementing ASU 2020-06.

To date, we have identified eight issuers that have publicly announced this election. Several did so in December 2020 (Chart Industries, Integra Lifesciences, Vishay Intertechnology, Interdigital, and Shift4 Payments). A few more made this election in Q1 2021 (NovoCure, Box, and Bloomin’ Brands). All these companies early adopted ASU 2020-06 as of the beginning of this year.

More elections are likely as ASU 2020-06 becomes more widely adopted. However, this choice will likely not be universal: companies with low or negative GAAP net income will not experience meaningful EPS dilution from flexible settlement and the resulting full-share if-converted share count. Additionally, in sectors that are not EPS focused, companies may prefer the balance sheet optionality provided by the Flexible Settlement structure.

We will continue to monitor these trends as early adoption of ASU 2020-06 continues throughout 2021, and mandatory implementation applies in 2022.

Personal Views: The views expressed in this report reflect our personal views. This blog post is based on current public information that we consider reliable, but we do not represent it is accurate or complete, and it should not be relied on as such. The information, opinions, estimates and forecasts contained herein are as of the date hereof and are subject to change without prior notification. The large majority of reports by us are published at irregular intervals as appropriate in our judgment and ability to produce, so updates may not be made or available even when circumstances may have changed.

No Offer: This analysis is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. It does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. You must make an independent decision regarding investments or strategies mentioned on this website. Before acting on information on this website, you should consider whether it is suitable for your particular circumstances. You should not construe any of the material contained herein as business, financial, investment, hedging, trading, legal, regulatory, tax, or accounting advice. The price and value of investments referred to in this analysis and the income from them may fluctuate. Past performance is not a guide to future performance, future returns are not guaranteed, and a loss of original capital may occur.