In a prior post we examined the nascent shift from convertible bonds being structured predominantly as “Flexible Settlement” towards being structured as “Net Share Settled”. This migration began in 2021 as issuers began to early-adopt the new accounting standards under FASB’s Accounting Standards Update No. 2020-06 (ASU 2020-06) applicable to convertible bonds.

With the new US accounting treatment now fully phased in and applicable to all issuers since 2022, we re-examine the data on convertible bond structures and find that about one third of new convertible bonds are now structured as net share settled. A higher concentration of these occurs among issuers with positive net income, who are more likely to be EPS-sensitive. We also examine why issuers who use Flexible Settlement initially may later make an irrevocable election to Net Share Settle those bonds and look at some issuers who have made such an election to date.

New Accounting Standards of ASU 2020-06. To recap, under the new standards, an “in-the-money” share computation for computing the diluted EPS denominator applies only to bonds that are structured as Net-Share Settled: conversions are settled up to the principal amount in cash, with in-the-money value settled in shares (the issuer can have the option to settle in-the-money amounts in cash as well). If bonds have Flexible Settlement (issuer may elect cash, shares or a combination), the EPS denominator assumes full-share settlement.

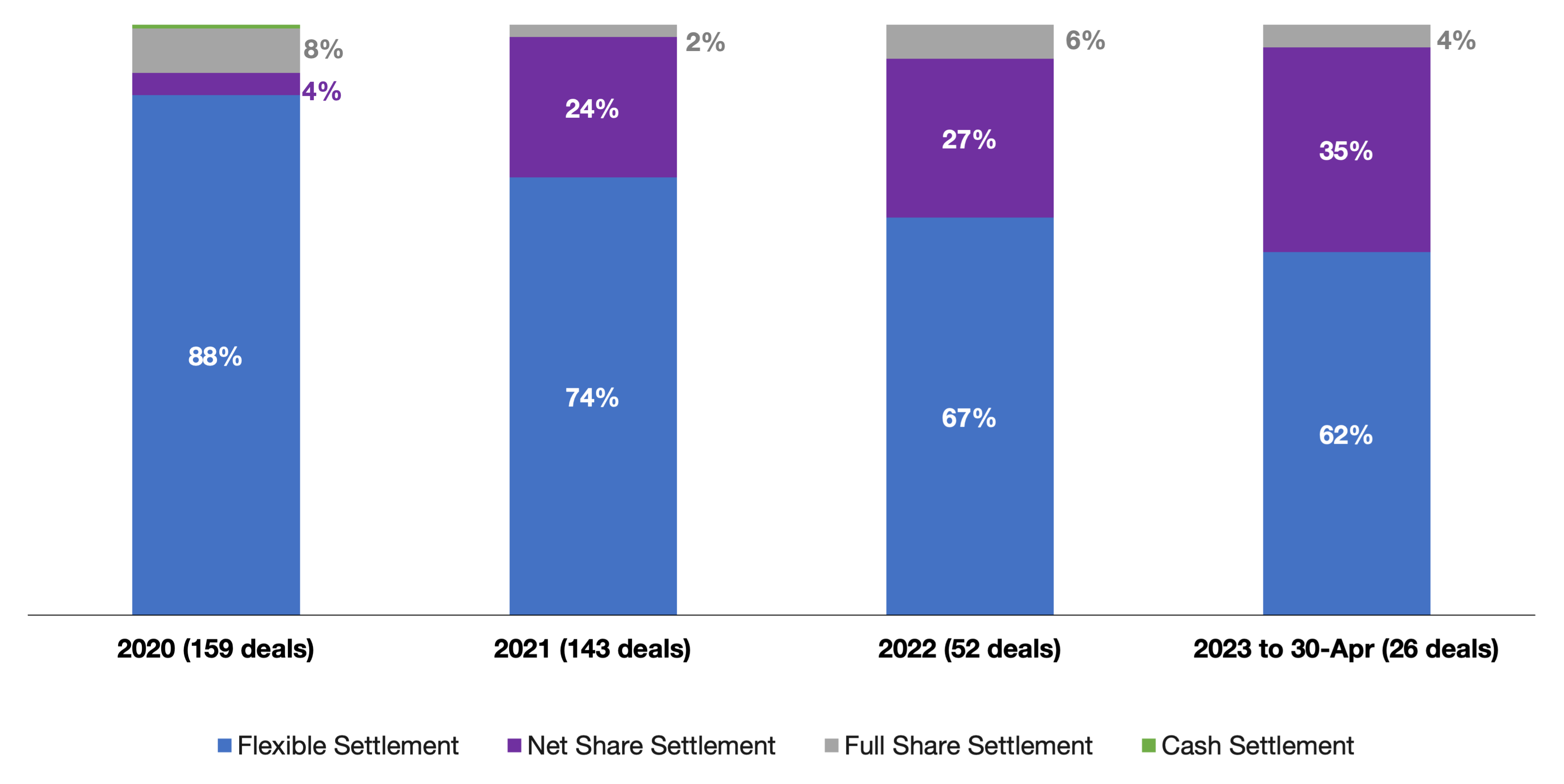

New Issue Trends. Issuers with Flexible Settlement previously could use an in-the-money share computation if they established an intent to net-share settle conversions. As a result, through 2020 the vast majority of new issue bonds (88% in 2020) were structured with Flexible Settlement, with many issuers taking advantage of the net-share-intent approach. Only a few deals were structured as true net share settlement.

2021 saw a shift towards Net Share Settlement as companies either early adopted ASU 2020-06 or anticipated its adoption. In 2022 and 2023, this continued a bit further with 27% and 35% of deals, respectively, being structured with Net Share Settlement.

Note that most bonds are still structured with Flexible Settlement. Companies value the balance sheet flexibility of not being forced to use cash to settle conversions. Moreover, many companies are not sensitive to the share count computation for the diluted EPS denominator, either because they have negative net income (in which case dilutive shares are ignored) or they are in industries where valuation is not EPS-based.

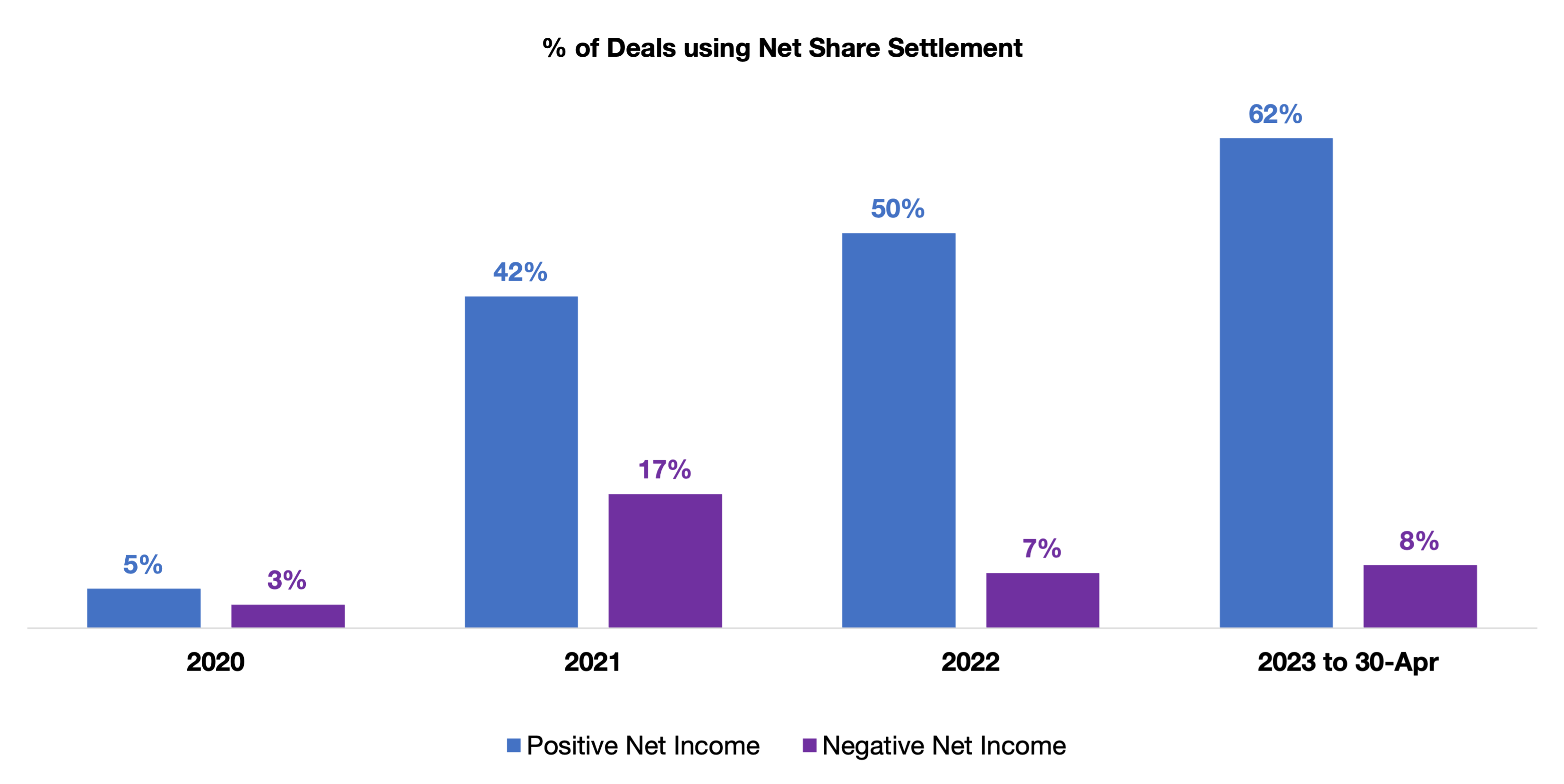

To validate this hypothesis, we filtered settlement structure by whether issuers had positive or negative LTM net income at issuance. The result was as expected: positive net-income companies, likely to be more sensitive to EPS impact from computed convertible dilution, have been much more likely to shift to the Net Share Settlement structure.

Irrevocable Election of Net Share Settlement. Finally, using Flexible Settlement structure at issuance of a convertible bond is not the last word. Convertible indentures reserve issuers’ right to unilaterally reduce their settlement choices and turn a Flexible Settlement bond into a Net Share Settlement bond.

In the last 18 months, this election has been used by issuers who reached their adoption date at the end of 2021 (or in mid-2022 for non-calendar fiscal year companies), to convert pre-ASU bonds into Net Share Settlement bonds. Examples include Akamai Technologies, Nice Ltd, Silicon Labs and Western Digital. We anticipate that some issuers who started with Flexible Settlement because of negative net income or EPS insensitivity may eventually use this mechanism to flip to Net Share Settlement once earnings turn positive.

Please reach out to Matthews South for any questions involving convertible structuring or the convertible markets more generally.

Personal Views: The views expressed in this report reflect our personal views. This blog post is based on current public information that we consider reliable, but we do not represent it is accurate or complete, and it should not be relied on as such. The information, opinions, estimates and forecasts contained herein are as of the date hereof and are subject to change without prior notification. The large majority of reports by us are published at irregular intervals as appropriate in our judgment and ability to produce, so updates may not be made or available even when circumstances may have changed.

No Offer: This analysis is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. It does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. You must make an independent decision regarding investments or strategies mentioned on this website. Before acting on information on this website, you should consider whether it is suitable for your particular circumstances. You should not construe any of the material contained herein as business, financial, investment, hedging, trading, legal, regulatory, tax, or accounting advice. The price and value of investments referred to in this analysis and the income from them may fluctuate. Past performance is not a guide to future performance, future returns are not guaranteed, and a loss of original capital may occur.