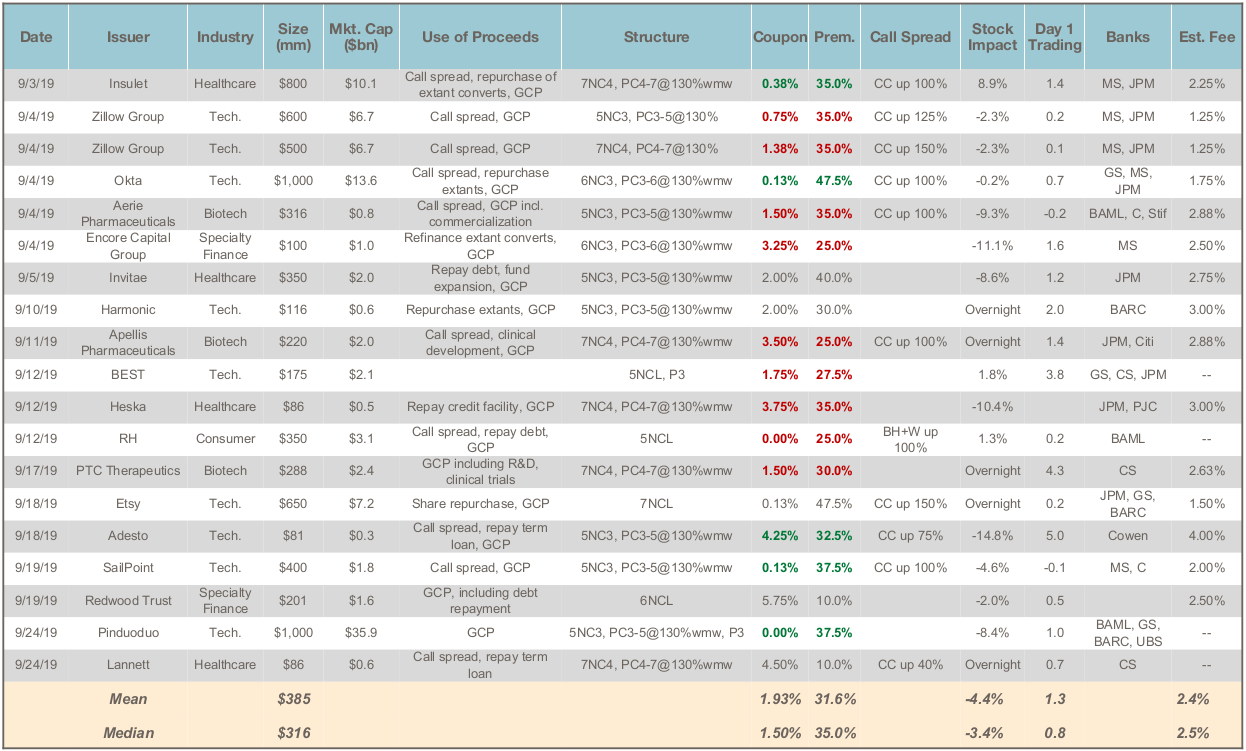

- Total Issuance: September was the busiest month of the year, surpassing August. There was $7.3 billion of convertible bond issuance over 18 transactions, bringing the 2019 total to $34.2 billion (vs. $35.7 billion for the same period in 2018). There was also $4.75 of mandatory convertibles issued by Broadcom and NextEra Energy, bringing the combined total to more than $12 billion of paper in the month.

- Reduced-Market Risk Execution: Possibly reflecting an adaptation to the macro choppiness of the last several months, September saw an unusually high proportion of overnight deals (5 of the 18 debt deals, plus NEE’s mandatory). In some deals, the stock price dislocation was offset by a repurchase of stock (Etsy) or existing convertibles (Harmonic). In several other instances, issuers used “over the wall” marketing processes to generate demand prior to an accelerated overnight offering. RH (Restoration Hardware) launched its transaction mid-day, which also reduced market exposure.