As part of our market update series, here are our key takeaways from the convertible market in the first quarter of 2024.

- The convertible market started 2024 with a very active quarter yielding ~$20 billion of new issuance. The past quarter was the busiest quarter since the “covid wave” in Q1 2021.

- Refinancings (of both convertible and non-convertible debt) continue to be the dominant trend in the market, accounting for ~2/3 of new issue deals. Issuers with outstanding convertible notes due within the next 2 years are actively considering and evaluating refinancing options.

- Sector diversification continues to exemplify the attractive opportunity for all issuers in the convertible market. Specifically, technology was the most active sector in Q1 2024 accounting for roughly a third of all volume, which was fueled by the technology stock rally.

- The convertible market continues to provide issuers with structural flexibility to cater to individual financing needs: BrightSpring Health Services priced a $460 million Tangible Equity Units offering concurrent with its Initial Public Offering and Albemarle priced a $2.3 billion Mandatory Convertible securities.

New Issuance: Q1 2024 saw 30 new issue deals (28 convertible notes and 2 mandatory securities) with a total volume of $20.2 billion, which surpassed issuance levels for every quarter since Q1 2021. The surge in new convertible issuance is in line with the broad equity rally, with the S&P 500 and Nasdaq indices gaining 10.6% and 8.7%, respectively, giving issuers the ability to raise at higher stock prices. Average deal size in Q1 2024 was ~$675 million, which is ~$100 million higher than the historical average deal size from 2020 – 2023.

The below chart shows the breakdown of deal count and volume from each sector. Technology is the most robust sector accounting for 32.8% of the new issuance volume. It is also worth noting the sector diversification of new issuers.

| Sector | Volume | Deal Count |

| Technology | $6.6 billion | 10 |

| Basic Materials | $3.0 billion | 2 |

| Healthcare | $2.4 billion | 6 |

| Industrials | $2.4 billion | 2 |

| Financials | $2.1 billion | 2 |

| Real Estate | $1.6 billion | 3 |

| Consumer Cyclical | $500 million | 2 |

| Utilities / Energy / Communication | $1.6 billion total | 1 each |

Terms: Investor sentiment has been receptive as evidenced by coupon decline in Q1 2024 compared to recent years. Most notably, Super Micro Computer priced its 5-year convertible notes at 0.00% coupon and 37.5% conversion premium. This marks a return of zero coupon convertible offerings which were more common in 2020 – 2021 when interest rates were at all-time low. Additionally, Coinbase also priced its 6-year convertible notes at 0.25% coupon and 32.5% conversion premium.

|

Sector

|

2021 | 2022 | 2023 | Q1 2024 |

| All Deals | 1.42% / 37% | 3.45% / 29% | 3.50% / 30% | 2.50% / 31% |

| Technology Sector | 0.39% / 42% | 2.68% / 31% | 2.80% / 27% | 2.00% / 32% |

| Healthcare Sector | 1.59% / 34% | 3.08% / 30% | 2.56% / 30% | 2.35% / 32.4% |

| Avg. 5y UST | 0.86% | 3.01% | 4.07% | 4.12% |

Note: Excludes mandatory convertible transactions.

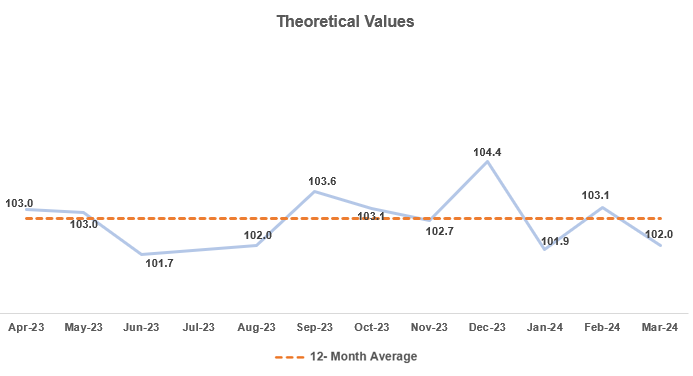

Pricing Results – Theoretical Value: The graph below shows how much cheapness was priced into deals over the past 12 months. The Q1 2024 average was 102.3, which is slightly below the 2023 average of 102.6. Looking at this chart and the previous table, it is evident that with the equity rally in the new year, convertible issuances were priced more aggressively.

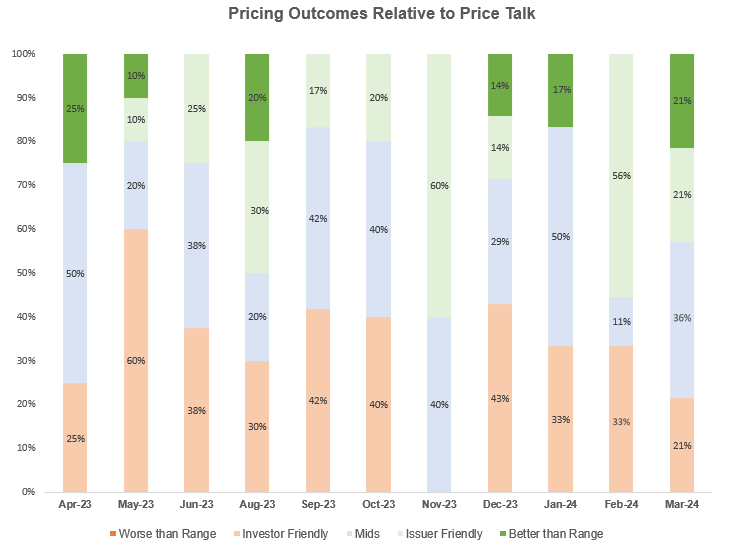

Pricing Results vs. Price Talk: As seen below, dynamics of pricing outcomes continued to develop throughout Q1 2024. In March 2024, approximately 80% of the new issuances were priced at mid-range or better, which marked the best performing month over the past twelve months. The graph below is a testament to strong investor appetite for new convertible issuance.

Day 1 Trading: On average for the quarter, deals traded up 2.2 points on a stock-price adjusted basis on the first day of trading compared to a 1.1 point average for 2023. This is likely a result of market demand being greater than underwriters expected.

Personal Views: The views expressed in this report reflect our personal views. This blog post is based on current public information that we consider reliable, but we do not represent it is accurate or complete, and it should not be relied on as such. The information, opinions, estimates and forecasts contained herein are as of the date hereof and are subject to change without prior notification. The large majority of reports by us are published at irregular intervals as appropriate in our judgment and ability to produce, so updates may not be made or available even when circumstances may have changed.

No Offer: This analysis is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. It does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. You must make an independent decision regarding investments or strategies mentioned on this website. Before acting on information on this website, you should consider whether it is suitable for your particular circumstances. You should not construe any of the material contained herein as business, financial, investment, hedging, trading, legal, regulatory, tax, or accounting advice. The price and value of investments referred to in this analysis and the income from them may fluctuate. Past performance is not a guide to future performance, future returns are not guaranteed, and a loss of original capital may occur.

No part of this material may be (i) copied, photocopied or duplicated in any form by any means or (ii) redistributed without the prior written consent of Matthews South, Inc.

Related Article