In 1975, the Congress passed The Securities Act Amendments of 1975. As a part of the amendments, Section 13(f) of the Securities Exchange Act of 1934 requires an institutional investment manager to file quarterly ownership reports with the SEC on File 13F within 45 days after the end of each calendar quarter. This report must be filed as long as a manager has an aggregate equity and equity-related AUM of at least $100mm.

The 13F reporting rules apply to a list of “Section 13(f)” securities that the SEC publishes every quarter. Convertible securities have been historically included in this list.

Recent Developments

The SEC is proposing to amend Rule 13f-1 and Form 13F to increase the reporting threshold from $100mm to $3.5bn. That is, funds with less than $3.5bn of AUM would be exempt from Rule 13f-1 filing requirements. The SEC has used the ratio of the U.S. equity market value in 2018 vs. equity market value in 1975 to calculate this new threshold.

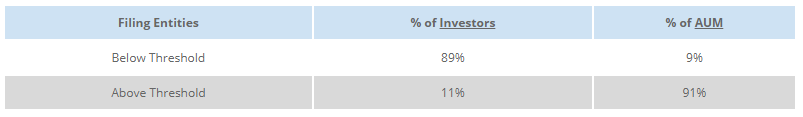

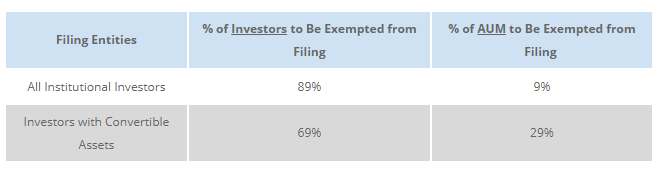

As of December 31, 2018, 5,089 filers reported assets of $25.2 trillion on Form 13F. The proposed changes would retain disclosure of 91% of the dollar value of the holdings, but it will eliminate filing requirement for approximately 4,500 filers or 89% of all current filers with ~$2.3 trillion of assets.

The SEC believes that these rule changes will reduce regulatory burden for smaller institutional investors and generate estimated cost savings of $68mm to $136mm.

You can see the details on the proposed rules here.

Broad Impact

The proposed changes do not specifically mention AUM aggregation rules, so per current rules, the new AUM threshold is likely to apply to the total fund complex. This will lessen the impact of the rule changes.

Still, given the AUM calculation is based on Section 13(f) securities, many sizable funds could be below the filing requirement threshold. In addition to the obvious points (i.e. lowering disclosure costs for funds vs. reducing transparency), there could be a number of broader consequences from the rule changes:

- Competitive advantage for smaller funds

- Increased activism risk, particularly for small and mid cap companies

- Potentially lower secondary liquidity for convertible securities, although no direct impact to issuers

Impact on Convertibles

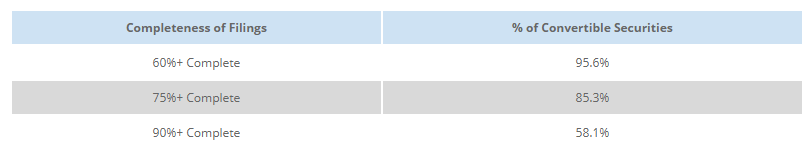

While convertibles are less liquid than equity and often trade by appointment, the holders’ lists for convertible securities tend to be surprisingly complete. We analyzed 136 seasoned convertible debt securities in our system that were issued over a 2 year period in 2017-2018. On average, the holders’ lists are 88% complete, and more than 85% of the securities had at least 75% completeness. We defined completeness as total reported size divided by principal amount outstanding.

The SEC proposal does not specifically mention convertibles. However, it is likely that the rule changes would apply to convertibles also as they are generally included in the list of Section 13(f) securities.

In order to ascertain the impact of the proposed rule changes to the convertible market, we analyzed 5,360 13F filings for the quarter ended March 31, 2020. We found that 69% of all convertible filers will be below the new threshold vs. 89% of all filers. This is because the convertible investor universe has a “shorter tail” of smaller funds vs. the equity investor universe.

More importantly, 29% of convertible AUM will be below the new cut off vs. only 9% for all 13(f) reported assets. This underscores that given the smaller size of the convertible market vs. the US equity market, the new cut off is disproportionately large for convertibles.

Based on these datapoints, we estimate that the average completeness factor for convertible holders’ list could drop from 88% to 64%.

Of interest, we saw 10-15 investors below the cut off list who occasionally appear in the top holders’ lists of convertible securities. We estimate that in the future, a top 10 convertible holders’ list could have 1-2 fewer reportings for a given issuer. This might mean that in some cases, issuers and banks will not be able to fully rely on Bloomberg holders’ lists for convertible liability management transactions (e.g. a convertible exchange or new issuance + concurrent repurchase) given visibility into existing holders is key in those situations.

Next Steps

The SEC is currently asking for comments on the proposed rule changes, and you can submit comments through here or by sending an email to rule-comments@sec.gov with “File Number S7-08-20” on the subject line. You can also see other comments posted here. The SEC will consider these comments as it drafts the final rules.

At Matthews South, we have already devised an alternative strategy which would allow issuers to retain the current level of visibility into the holders’ lists even if the rule changes go through. Please email us if you have any questions.