This is the first of a three-part series of posts examining the redemption features of SPAC warrants: here, we describe the typical redemption features found in SPAC warrants. In subsequent posts we will examine (1) how to approach the decision whether and when to redeem warrants and (2) what redemptions have occurred in the market to date.

Companies that go public via SPAC merger ultimately end up with the SPAC’s warrants in their capital structure.1 These warrants almost always have 5 year maturities (measured from the closing date of the merger), with an $11.50 strike price (vs. a $10.00 SPAC IPO price).

SPAC warrants are redeemable by the issuer under one of two circumstances described below – one that applies above $18.00 stock prices, and one that applies above $10.00.

Intrinsic Redemption

Older SPAC structures generally had only one redemption right: issuers can redeem the warrants for a nominal value (e.g., $0.01) if the stock traded above $18.00 for 20 out of 30 trading days, with 30 days notice. The nominal redemption price effectively forces investors to exercise their warrants, paying $11.50 for the shares (strike price) and capturing the in-the-money value (i.e. value between $11.50 and share price at that time).

Under this redemption feature, most (but not all) warrants allow the issuer to force “cashless” exercise. This results in a net-share settlement: investors receive a fraction of a share per warrant based on the intrinsic value of the option at the time of redemption. In other words, rather than paying for the shares out of pocket and getting the total number of shares owed, investors get the net value owed to them by receiving fewer shares.

- Standard physical settlement: after the notice of redemption a rational holder will pay the $11.50 strike price and receive 1 share per warrant. In the aggregate, the company will receive $115 million and issue 10 million shares. For each warrant, the investor receives $8.50 worth of value (having received one share worth $20.00 at a cost of $11.50).

- Cashless exercise: In a cashless exercise, the $11.50 strike price is paid by reducing the number of shares issued. At $20.00, the $11.50 strike price is paid by withholding 0.575 shares per warrant ($11.50 / $20.00). Investors therefore receive $8.50 of in-the-money value in the form of 0.425 shares. In aggregate, the company issues 4.25 million shares and receives no cash.

Make-Whole Redemption

Overview

Most SPACs from the last few years have a second redemption feature, the make-whole redemption. Under this feature, issuers can redeem the warrants if the stock price exceeds $10.00 (again, generally measured based on 20 out of the last 30 trading days). Upon redemption, investors can exchange their warrants into a fractional number of shares specified in a table. The fractional share values in the table are a function of stock price and remaining time to warrant expiry. Note that this redemption is a cashless exercise of the warrants.

The make-whole table, a concept borrowed from public market convertible bonds, is designed to approximate the market value of the warrants, including the “time value” of the option. As such, for a given share price, make-whole tables go from higher values early in the life of the warrant to lower values near the expiry. In all instances, the value of the share settlement equals or exceeds the intrinsic value of the warrants because of the time value.

Standardized Tables

In analyzing the make-whole redemption feature, we first note that the numerical tables are extremely standardized. This is unlike convertible bond make-whole tables, which are based on issuer-specific valuation inputs. Through an algorithmic review of SEC filings since 2017, we identified 566 distinct companies (including both pre-merger SPACs and post-merger companies) that have warrants with redemption make-whole tables. Of these companies, the tables for 551 of 566 (97.3%) have identical or nearly identical table values.2

The warrant make-whole tables are fixed at the time of SPAC IPO, before they merge into companies with unique business or financial characteristics. By market convention, the warrant values in these tables are all computed with a 40% volatility assumption.

Table Values

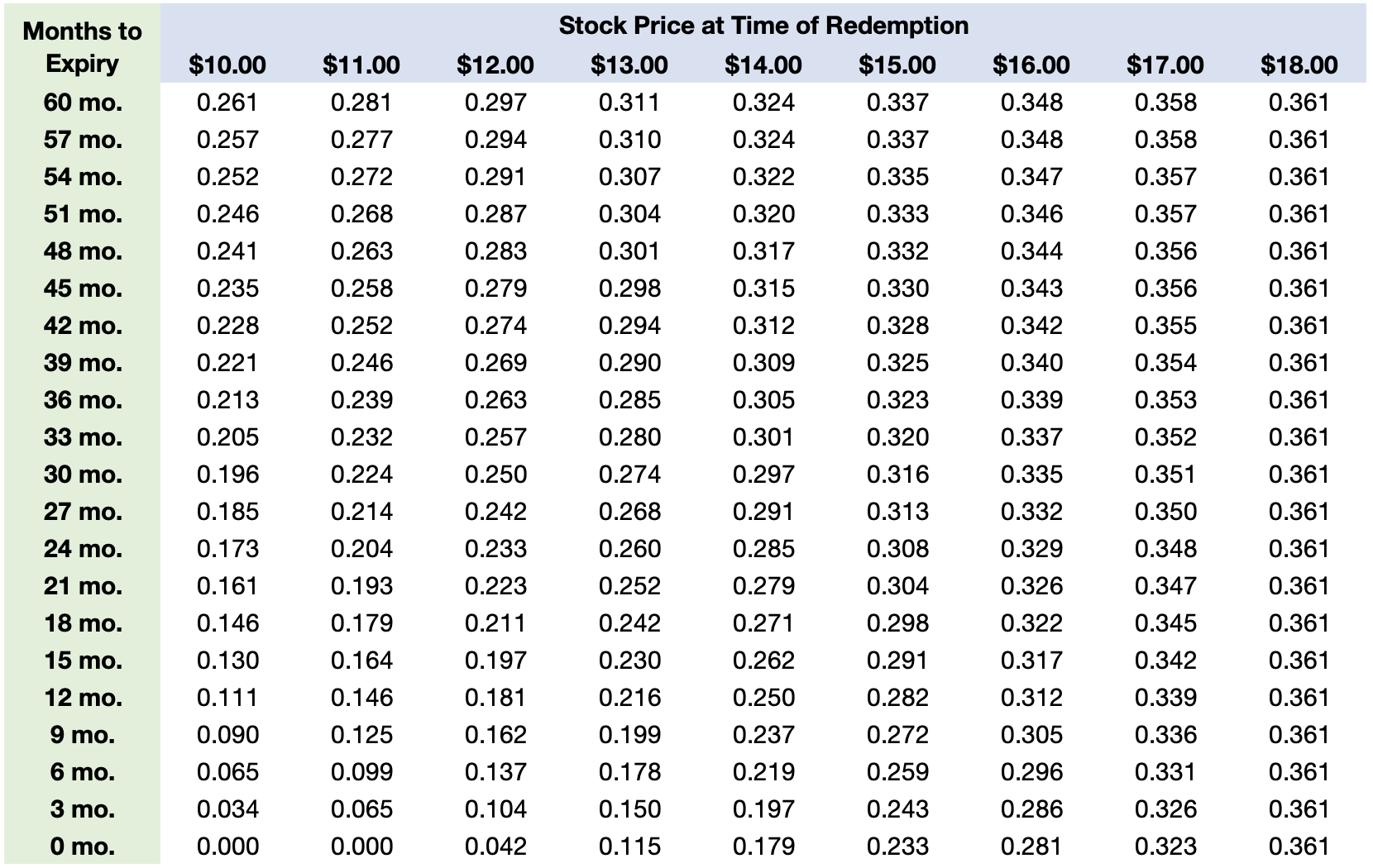

Below is a typical make-whole table from a warrant agreement:

The tables have the following pattern: redemption early in the life of the warrants at low stock prices results in a payout consisting entirely of time value (0.261 shares per warrant at $10.00, with 5 years remaining), which decays as time progresses. At higher stock prices, where the warrants are freely redeemable, the value of the make-whole redemption converges to the “intrinsic” (i.e., in-the-money) value of the warrants at $18.00 (0.361 shares per warrant, representing $6.50 of in-the-money value at $18).

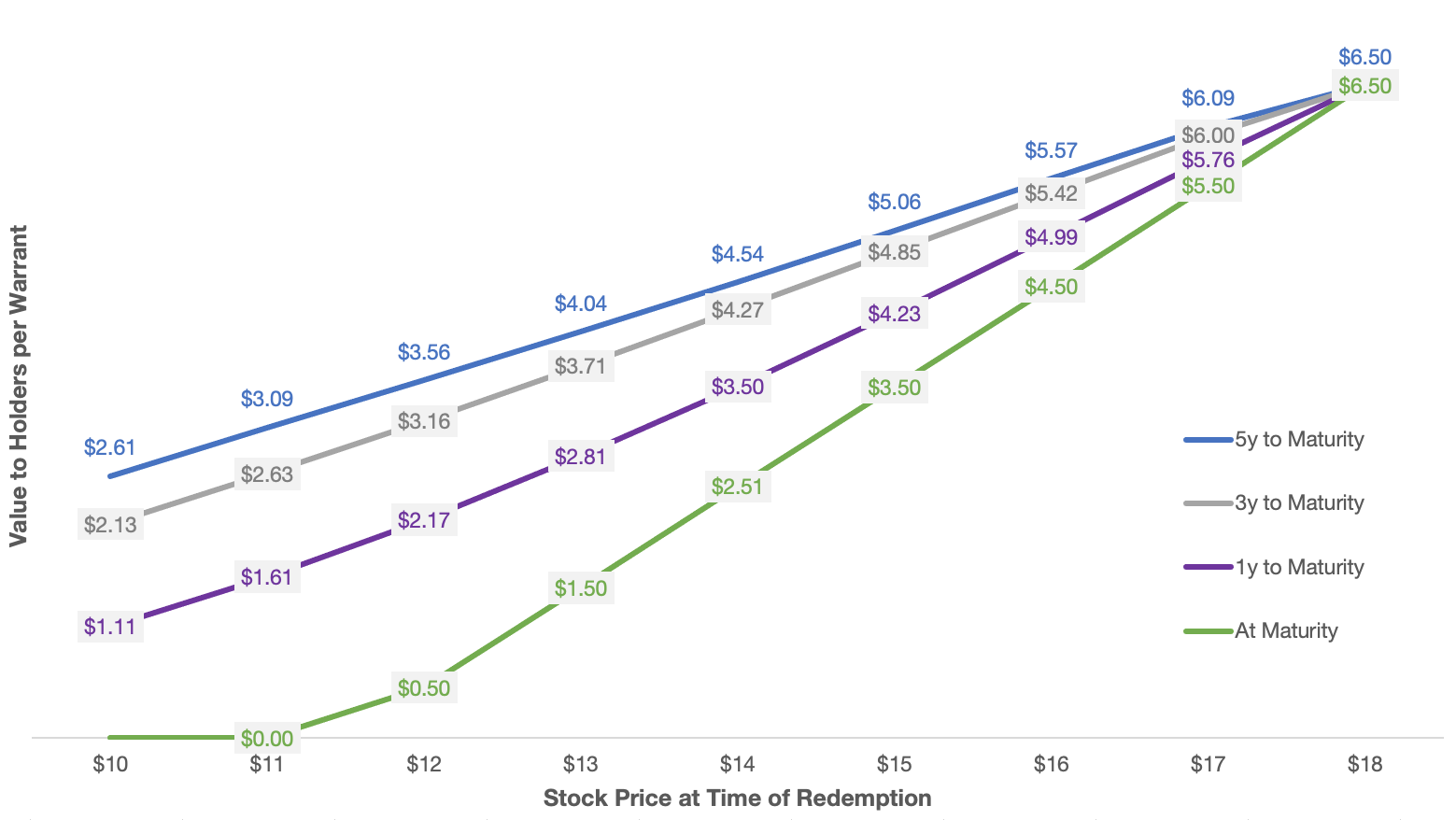

The graph below converts the share numbers of the make-whole table into dollar values per warrant. Note that the values at maturity (green line) represent the intrinsic value of the warrant; higher values prior to that reflect the time value remaining earlier in the warrant’s life.

Forward-Looking Measurement Period

The measurement period for determining the number of shares issued upon a Make-Whole Redemption is usually forward-looking. Typically, the reference share price is based on the 10-day average after the notice of redemption is sent.

Thus, in this form of redemption there is no ability for the issuer to retire the warrants for a value lower than that implied by the stock price at the time of issuing the redemption notice.

Conclusion

The provisions of SPAC warrants governing redemptions are complicated and can have material consequences to a company’s capital structure and share count. De-SPAC issuers have a significant number of warrants outstanding and understanding how to manage this exposure is important to optimizing capital structure.

Please contact the Matthews South team if you have any questions.

1 Most, but not all SPACs have warrants. We have identified 39 SPAC IPOs in which only common shares were sold to investors.

2 The differences we found from the most frequent make-whole table template were: (1) some tables exclude the row for 5 years remaining to maturity and start at 4.75 years, (2) a number of tables differed by only 1-2 entries (these appear to be mostly typos) out of 180 values, and (3) in some instances, one column or row differed by an immaterial amount.

Related Articles

Post-SPAC Warrant Redemption Features (Part 2)