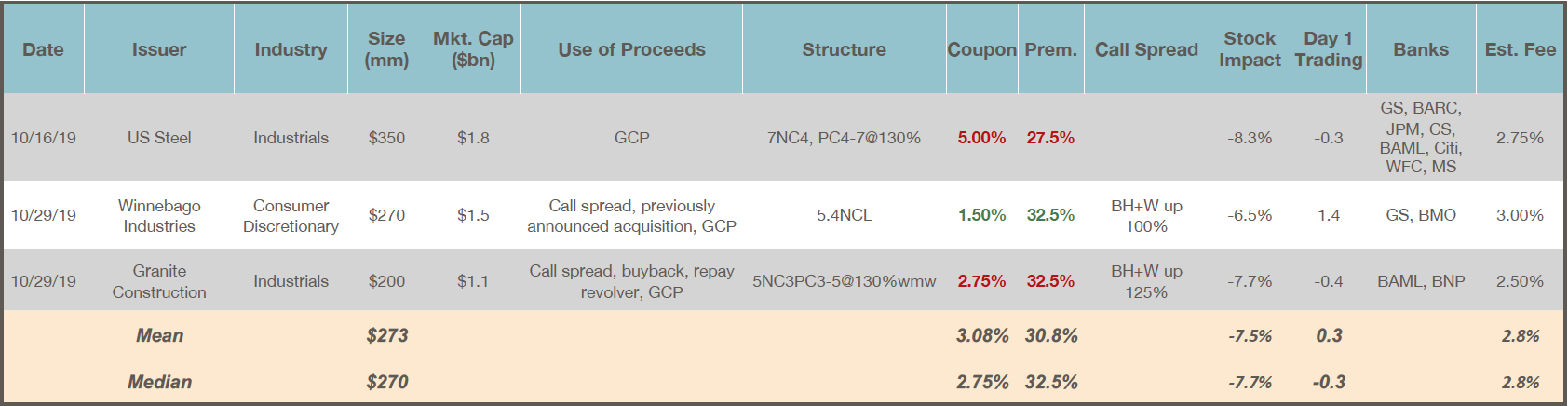

- Total Issuance: October was typically quiet, with the majority of issuers in blackout for the bulk of the month pending Q3 earnings releases. $820mm of convertible debt priced in 3 transactions, bringing the YTD total to $35.1 billion (vs. $37.0 billion for the same period in 2018). Mandatory convertible issuance continues as well, with a $1.15 billion equity units offering by DTE Energy.

- Sector: October was notable in that it was the first month in 2019 without an offering from a technology-sector issuer. All three issuers were common dividend payers resulting in terms providing a bit more yield than typical for the convertible market.