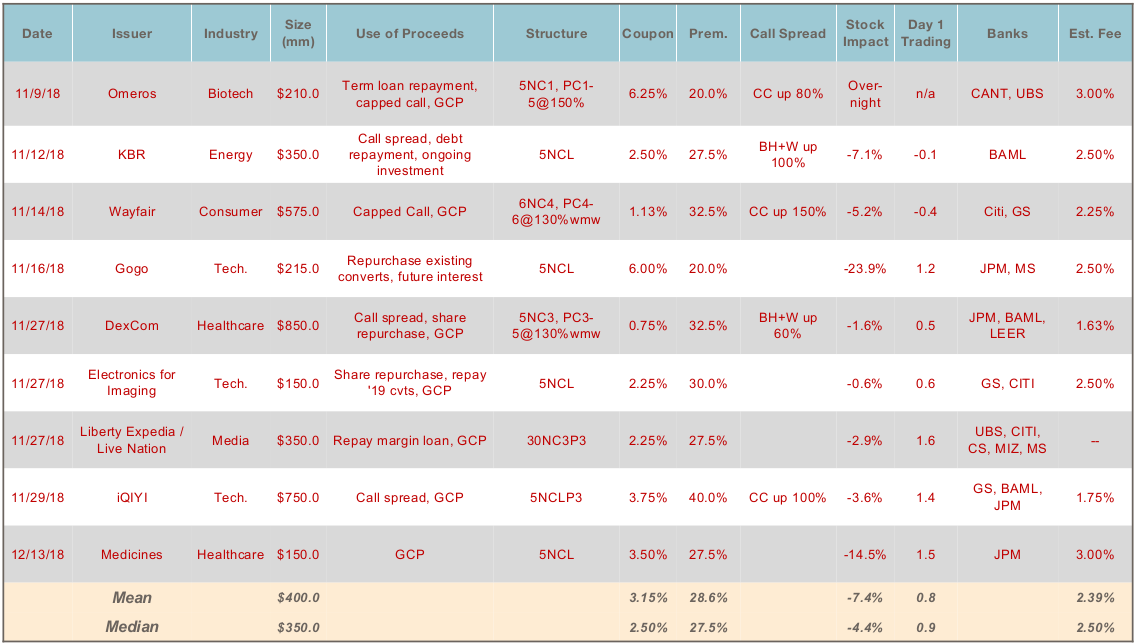

- Total Issuance: Despite the uptick in market choppiness starting in late October, the convertible primary market priced a healthy amount of new issue paper since the start of November: $3.6 billion across 9 deals (plus another $200mm currently on offer by Benefitfocus set to price this afternoon). 2018 issuance now stands at $40.6 billion, up 44% from 2017’s $28.2 billion. The technology sector continued to lead in deal count. Given market conditions, this activity occurred in fits and starts, with a several week hiatus at the start of November and a 2 week pause in the start of December. In addition, two convertible debt offerings were withdrawn after initial launch (Ribbon Communications in November and RH in December), as was a convertible preferred stock offering for Post Holdings.

- Pricing and Day 1 Trading: All nine deals priced towards the investor-friendly end of the marketing range. That said, this pattern appears to have been an efficient reflection of choppier market conditions rather than a reflection of buyer leverage or windfalls — in day 1 trading the bonds averaged up less than 1 point on a stock-adjusted basis.

- Syndicate and Fees: The average number of bookrunners in September deals was 2.3, vs. the full year average of 2.4. Fees averaged ~2.4%, also in-line with full-year averages.

- Structure: Of the 9 deals, 4 were callable (notably Omeros had only a one year non-call period). Five of the deals had call spreads (48% YTD), of which the majority were capped calls, consistent with most activity this year.