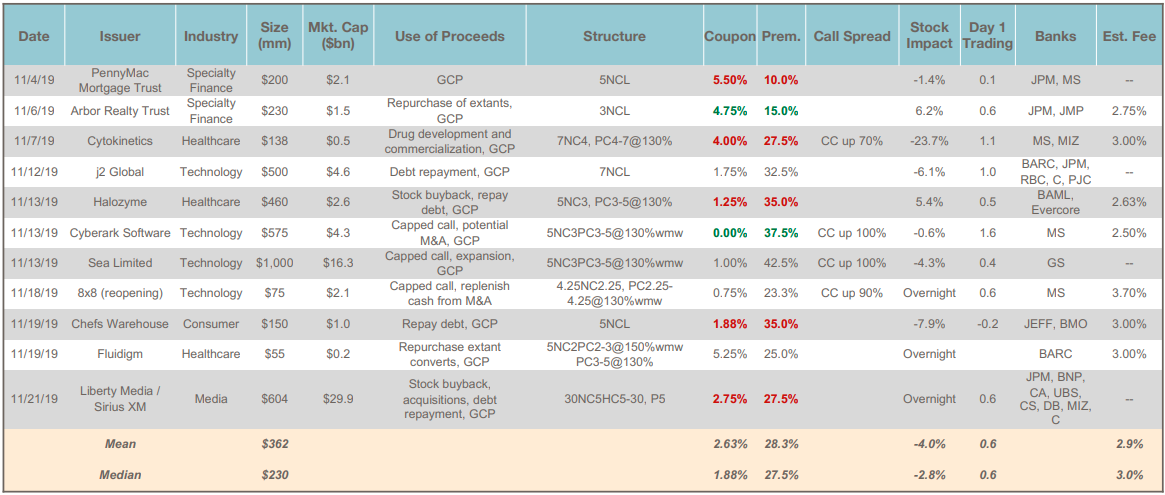

- Total Issuance: November activity picked up after a quiet October, with 11 convertible debt deals pricing for a total of $4.0 billion. This brings the YTD total to $39.1 billion — on pace to surpass last year’s full year total of $41.0 billion.

- Flexibility: November’s new issuance showcased the versatility of the convertible market when it comes to issuers pursuing custom objectives. Highlights included an overnight reopening of a recently issued bond to finance a small M&A transaction (see our commentary on transaction costs of that deal here), an overnight refinancing transaction for Fluidigm that represented 34% of its $161 million market capitalization, and an offering for Arbor Realty Trust whose conversion price was set using a several-day VWAP average.