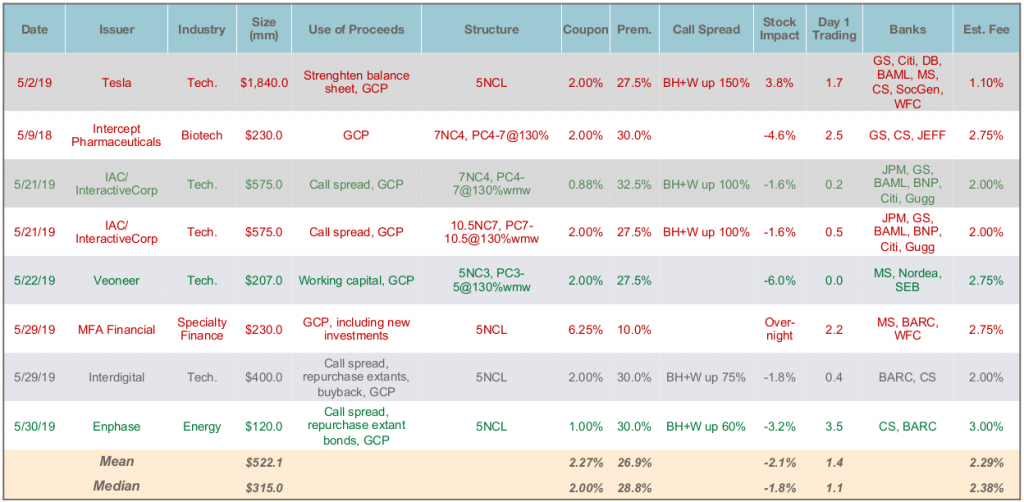

- Total Issuance: Activity picked up from April to May, with $4.3 billion of new convertible bond issuance over 8 transactions. Year-to-date there has now been $14.4 billion of total issuance in 31 deals. This is behind last year’s pace of $19.2 billion over 51 deals over the first five months of the year, as April – May 2018 saw the beginning of significant issuance in the tech sector that lasted through the summer.

- Long-Dated Bonds: While the data is limited to a single example, the contrast between the two IAC/InteractiveCorp tranches suggests investors are meaningfully more conservative when bond structure is outside the norm. While the 7 year tranche priced efficiently (tighter than initial talk at 0.875% up 32.5%), the 10.5 year tranche priced at 2.0% up 27.5%, which is a greater concession than what should be implied by the flat rate term structure and a normal credit curve.

- Liability Management: Not surprisingly, in light of the elevated market choppiness, May’s transactions are better characterized as capital structure improvement rather than the opportunistic financing that characterized many transactions last year. Of the 8 deals, three involved concurrent common stock offerings (Tesla, Intercept, and Veoneer) and three involved repurchases or exchanges of old convertibles (PROS Holdings, Interdigital and Enphase). Liability management transactions can be particularly useful in choppy markets as the repurchase of in-the-money old bonds creates a natural short-covering demand for shares from old investors, that can partially or totally offset the technical supply from hedge investors in a new offering. We expect many issuers of convertibles from the last several years whose stocks have appreciated to consider new offerings coupled with extant bond repurchases to term out their maturity structure and protect themselves against further dilution from their old bonds.