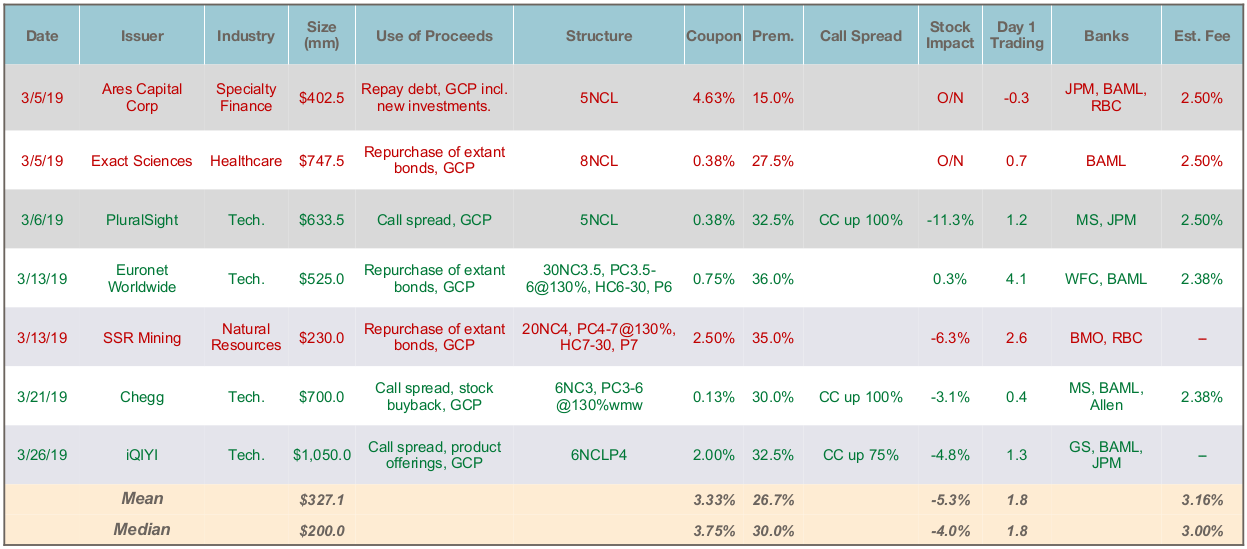

- Total Issuance: March continued the healthy primary market activity in February (allowing for many companies being in blackout at the end of the month), with 7 deals for $4.3 billion last month. The YTD total now stands at $8.4 billion across 18 deals, compared to $9.6 billion in 28 deals in Q1 2018.

- Investment Grade Opportunity: Like February’s Fortive deal, March saw another strong response to an investment grade issuer. Euronet Worldwide (rated BBB-) offered 6 year notes (callable after 3.5) at 0.75% up 36%, significantly better than the initial price talk of 1.0 – 1.5% up 30 – 35%. Once again, investors paid 100 for a security with a theoretical value less than 99 on reasonable market inputs, and the bonds traded up more than 4 points after issue. Potential investment grade issuers should note that in view of the relative lack of IG-rated paper, there is an opportunity to sell convertible bonds with low equity risk at terms significantly better than those available in the credit markets proper.

- Market Impact: Of the 5 marketed deals in March, the average stock price dislocation was 5.0%. This is a bit higher than the average impact of 3.7% for 2018, but a significant improvement from the November-December average of 8.6%, providing additional evidence of market normalization and risk appetite.