In the first installment of our three-part series on the financing landscape for life sciences issuers, we covered the evolution of the typical life sciences IPO. In the second installment, we covered post-IPO financing dynamics and the importance of laying the foundation for successful capital raises in this sector. In particular, we covered equity follow-ons, registered direct offerings, private investments in public equity (PIPEs), and at-the-market offerings (ATMs). This third and final installment will cover the path to issuing convertible debt for life sciences companies.

Most life science companies will access at least one of these strategies, and often more than one, depending on current market conditions and where they are in the financing life cycle. While convertibles play an important role in life sciences, how, when and why to issue a convertible are all questions that should be carefully considered. Particular care should be taken when evaluating a company’s path to profitability in order to optimize its benefits. Other relevant questions include size, maturity, whether to include a call spread, change of control risk, selecting the bank syndicate, accounting memo preparation, tax implications of the offering, etc. Good planning also helps mitigate risks of unexpected situations arising during the term of the convertible.

What is convertible debt?

Convertibles are securities that give investors the option to convert into equity (generally common stock) of a company. The most common structure is convertible debt, which is a debt security that investors can convert into company shares at a conversion ratio that is generally determined at the time of issuing the bond.

Just like traditional debt securities, convertibles generally pay semi-annual coupons. Interest offered by convertible bonds is lower than that of traditional debt instruments given the potential value investors receive through the right to convert into shares. Convertibles are often structured as senior unsecured debt obligations.

This overview does not consider mandatory convertible securities, where investors do not have a choice on whether to elect conversion, as they are rarely issued by life sciences companies (and typically only in M&A scenarios).

How important is the convertible market in healthcare?

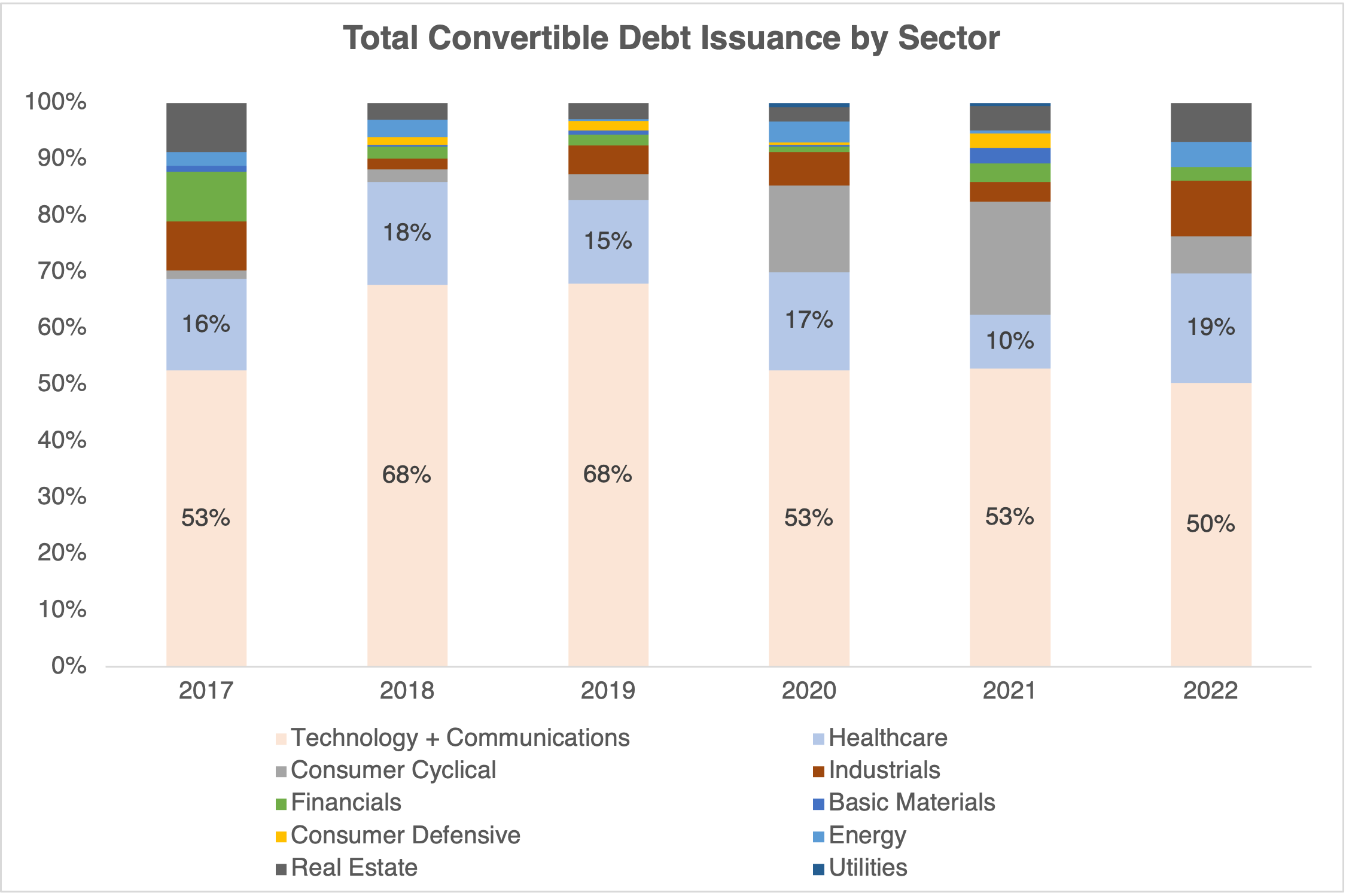

The convertible market has always played an important role in financing of high-growth, non-rated companies. Companies with ratings also access the convertible market, including investment-grade rated issuers. Over the years, technology and healthcare have been the two most active sectors – healthcare has occupied anywhere from 10 to 19% of the overall market.

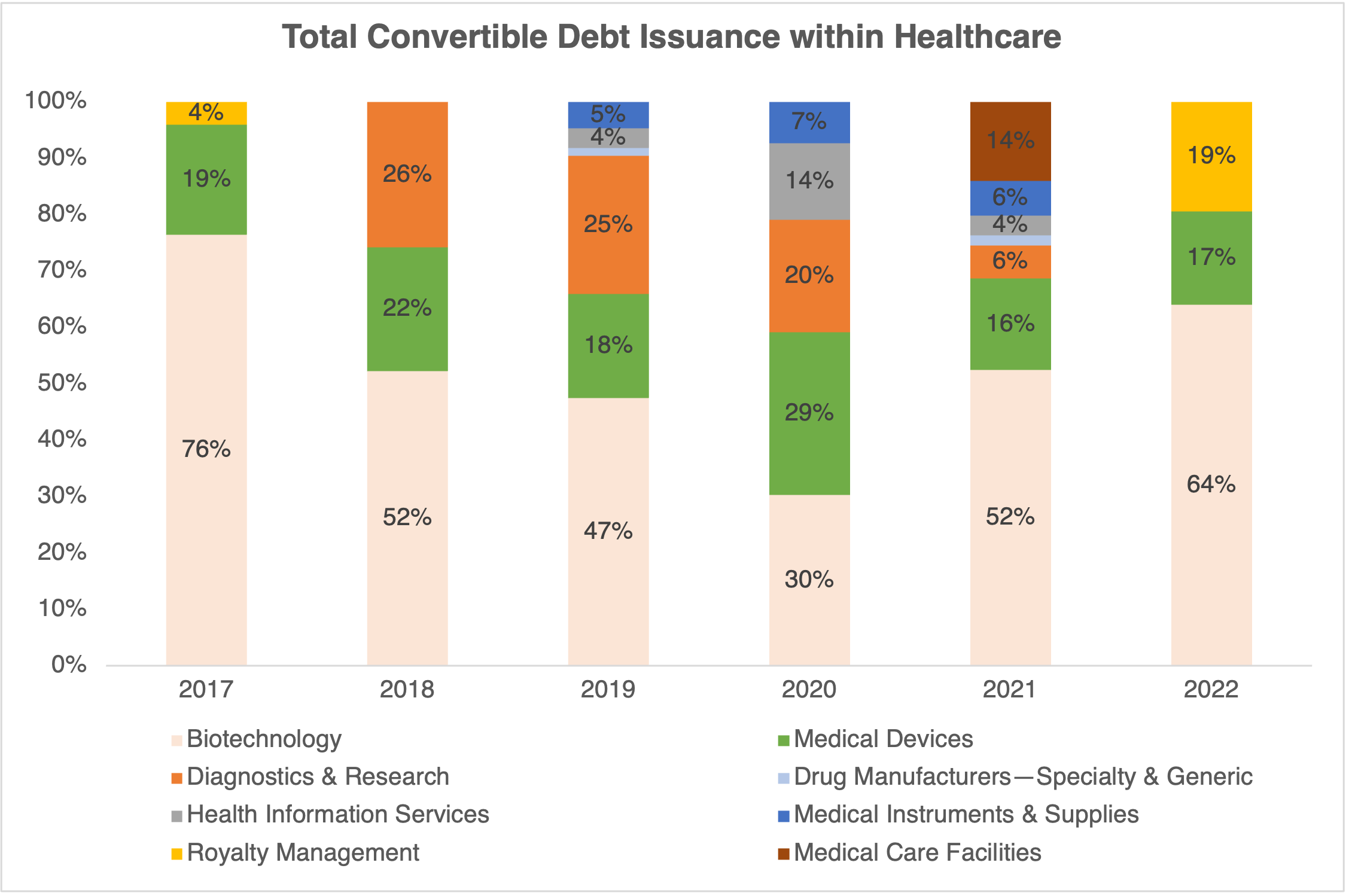

Within healthcare, biotechnology has traditionally been the most active sector, followed by medical devices and diagnostics & research. While biotechnology generally dominates over the years, 2020 was more balanced and we saw increased participation from health information services and medical instruments & supplies. So far in 2022, out of all healthcare issuance, biotechnology has comprised 64% of total volume (albeit on unusually low issuance).

When considering convertibles, what other financing options do issuers look at?

A decision to evaluate convertible debt as an alternative usually comes when an issuer is looking to limit further dilution. At that point, the company has likely done at least one form of equity financing and is considering whether debt financing is prudent. Debt financing (convertible or otherwise) can be particularly attractive when a company wants to extend its runway to reach an important milestone while avoiding dilution or when equity financing is not available or enticing. Ratings play an important role in determining what alternatives are available to an issuer as well.

Without ratings, companies only have access to equity, convertible and Term Loan A / relationship loan markets, as well as private placement debt. A non-investment grade rating provides access to the high-yield bond market and Term Loan B market, which can provide attractively priced fixed-cost capital; however, ratings are not always available. Generally, the rating agency perspective comes with an orientation that is skeptical toward growth. In fact, debt investors and rating agencies often ascertain credit-worthiness of a company based on historical cash flows (e.g., trailing EBITDA). Without a sizable positive EBITDA, it has historically been challenging to get a solid rating and access public debt markets.

As such, in the world of generally cash-burning biotech, convertibles are frequently compared to equity and term loan financing.

Equity financing does not add leverage on the balance sheet and eliminates the need for repayment. It also avoids interest payments and covenants. On the other hand, equity has the highest and most immediate dilution and careful messaging / execution is vital to avoid excessive stock price impact. For additional considerations around equity financing, including different forms that are available to issuers, please refer to our second installment of the life sciences blog series.

Term Loan Debt may be available to companies that do not have positive cash flows, nor significant assets to use as collateral. The traditional alternative is bank relationship loans, in which one or a small handful of banks close to the company extend credit (usually at below-market terms) on the expectation of future advisory or capital markets business. Because of the risks involved to lenders, these facilities are likely only to be available to larger, later-stage companies with meaningful current revenue or a clear path to it.

Private placement debt (including venture capital debt) has been gaining traction particularly in the software and biotech world. These term loans can come with high interest costs, but offer no dilution, and come with structuring flexibility, such as delayed draws (which allow contingent capital flexibility) and prepayment options. However, these deals often have high ongoing cash costs and restrictive covenants, such as achievement of milestones to unlock funding of some tranches, liens on IP, material adverse change clauses, etc. Some lenders may require warrant participation as well, resulting in incremental dilution. If a company does not wish to provide warrants, the interest rate it pays on its loan will likely be higher.

When should companies consider convertible debt?

The typical capital structure journey of a life sciences company involves issuance of some form of equity, primary or secondary, post IPO. Equity financing is typically done in the form of a marketed follow-on offering, though now many S-3 eligible companies (1-year after IPO) with high stock liquidity are also taking advantage of at-the-money offerings (ATM) to raise “passive” equity capital. We describe ATMs in detail in our second installment of the life sciences blog series.

Evaluating convertibles is generally an event that is considered later in the company’s financing life cycle when: 1) the profile of the company is more de-risked, 2) there is a true line of sight to revenue, and 3) the company has refinancing confidence. For a lot of biotech companies, this means commercialization – in fact, 79% of all biotech that accessed the market since 2017 had a commercial drug / product at the time of convertible issuance (conversely, only 21% were pre-commercial).

At this point in time, the issuer has also done at least one, if not multiple equity offerings. However, there are also some companies who have de-risked profiles earlier on and have accessed the convertible market immediately after an IPO (skipping a follow-on offering).

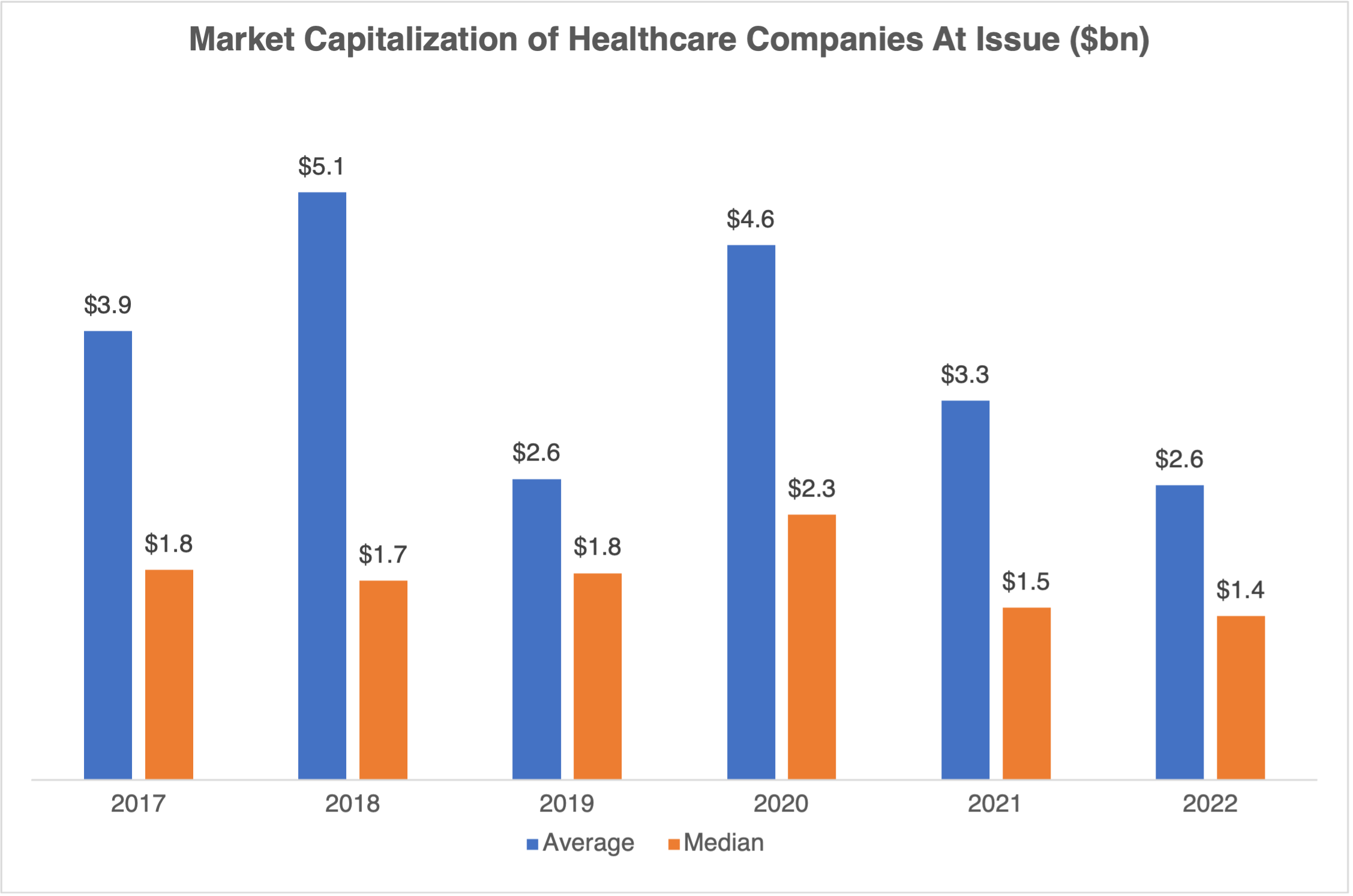

As the majority of issuance in life sciences comes from high growth biotech, we typically see small and mid-cap companies access the convertible market. Overall, median market cap (at the time of convertible issuance) in healthcare across years (2017-2022YTD) is $1.9bn, with as low as $121mm to as high as $48bn. In biotech, the comparable median is $1.5bn, with as small as $121mm and as large as $17bn. 2022 to date has seen issuance mostly by smaller companies.

What makes an attractive convertible debt issuer?

Although there are a few healthcare-specific funds (e.g. Baker Bros, Deerfield), the majority of the convertible investor universe is sector agnostic. In general, the investor universe can be divided into two big groups: non-hedge investors (also known as outright, fundamental, or long-only) and hedged investors (hedge funds or arbitrage accounts).

Non-hedged investors will focus on the company’s equity and credit stories. By definition, these investors buy and hold the securities with an orientation towards long-term investments. Path to profitability, refinancing confidence, breadth of pipeline (including whether the company is reliant on a single asset), size of the company, and size of convertible offering, all play an important role in their decision process.

Hedge fund investors focus more on the technical aspects of the offering that dictate how hedgeable their exposure would be if they were to participate in an offering. These investors buy the securities with a goal of hedging the underlying equity to monetize the company’s volatility. They will focus on the deal size as a percent of market capitalization and float, company’s liquidity (measured by the average daily traded volume, or ADTV), and stock lending (also known as “borrow availability”). Any pressure points in these metrics will raise concerns about their ability to appropriately hedge, and will either result in them not being as eager to participate and/or will heavily impact the company’s stock price during the day of marketing.

2022 has seen a drastic shift in primary issuance behavior in each of the major financing markets, including the convertible market. For a broader look at the equity, convertible, high yield and investment-grade markets, please refer to our recently published blog on the topic. In these highly volatile times, careful evaluation of deal technicals and de-risking strategies is paramount to deal success. Having an experienced advisor by your side becomes that much more important.

Why should a company access the convertible market?

Convertibles offer the middle ground between equity and debt. Convertibles are less dilutive compared to an equity offering (given share issuance, if any, is typically at a premium to the share price at the time of the offering). Because potential dilution is uncertain and fewer shares underlie the convertible compared to an equity offering, convertibles often see less stock price impact during the marketing of the transaction. The convertible market also has a differentiated investor base than equity and provides access to new pools of capital. Compared to debt, convertibles come with lower interest expense and none of the covenants that typically accompany a traditional or term loan debt financing.

Convertibles also offer settlement flexibility, and settlement method choice sits with the issuer. Depending on the settlement method, convertibles can be converted into company shares, cash, or combination of cash and shares – note: if the security matures with stock below the conversion price, the company needs to pay back the principal amount in cash (see below). Structuring flexibility of convertible instruments allows the issuer to tailor their offering to be more equity- or debt-like to best fit their needs. There are also derivatives that often get executed alongside a convertible, such as call spreads, which help issuers reduce dilution potential even further.

Why not access the convertible market?

Convertible bonds can be an attractive financing alternative and offer meaningful benefits relative to other financing options, but issuers should be cognizant of the risks. The biggest consideration for a cash-burning company is to understand that, despite the ability to convert into equity, convertibles are ultimately debt instruments and need to be repaid in cash at maturity if the company’s stock price fails to exceed the conversion price.

In addition to repayment risk associated with converts, issuers should also be aware that convertible investors are subject to protections in change of control events (i.e., when the convertible issuer is acquired for more than 10% cash). Investors typically have the right to either have their bonds redeemed at par or convert into shares and receive an additional make-whole amount.

The above list is not exhaustive and potential issuers should be mindful of structural, documentation, tax, and accounting complexity that accompanies these instruments. For this reason, an independent advisor is a particularly valuable asset to companies looking to evaluate convertible debt as a financing alternative.

Personal Views: The views expressed in this report reflect our personal views. This blog post is based on current public information that we consider reliable, but we do not represent it is accurate or complete, and it should not be relied on as such. The information, opinions, estimates and forecasts contained herein are as of the date hereof and are subject to change without prior notification. The large majority of reports by us are published at irregular intervals as appropriate in our judgment and ability to produce, so updates may not be made or available even when circumstances may have changed.

No Offer: This analysis is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. It does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. You must make an independent decision regarding investments or strategies mentioned on this website. Before acting on information on this website, you should consider whether it is suitable for your particular circumstances. You should not construe any of the material contained herein as business, financial, investment, hedging, trading, legal, regulatory, tax, or accounting advice. The price and value of investments referred to in this analysis and the income from them may fluctuate. Past performance is not a guide to future performance, future returns are not guaranteed, and a loss of original capital may occur.