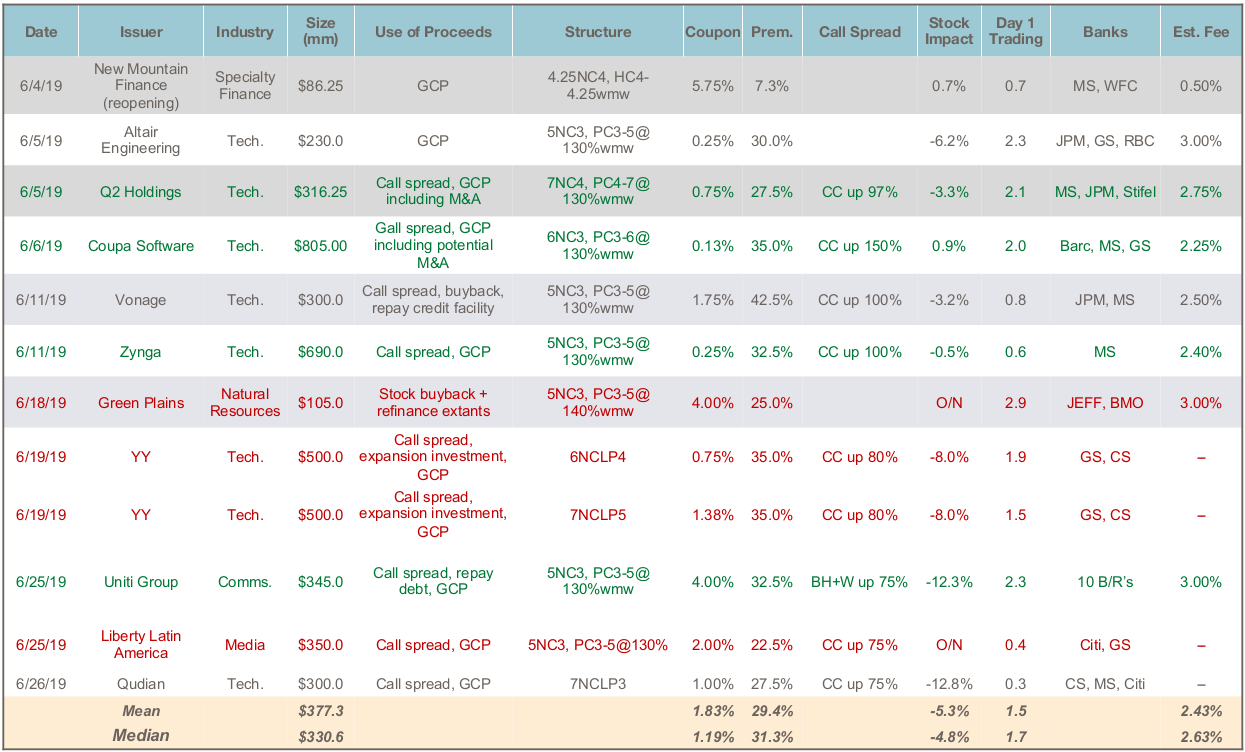

- Total Issuance: Activity remained robust in June, with $4.5 billion of new convertible bond issuance over 11 transactions (notwithstanding that many issuers entered blackout in the second half of the month). Year to date there is now $19.8 billion total issuance, less than 2018 1H’s total of $26.6 billion (but ahead of 2017 pace of $17.8 billion through the first half).

- Call Spreads: June saw a number of lower-strike call spreads (up 75-80%), predominantly from the non-US domiciled issuers. Coupa software executed an up 150% capped call, the third up 150% call spread in the last three months, and the pricing was nearly as aggressive as the more typical up 100%.

- Sector Distribution: The latter half of the month saw significant issuance from Chinese-domiciled issuers (YY and Quidian), continuing a trend throughout the year. The first half of the month saw significant volume from technology-sector issuers.