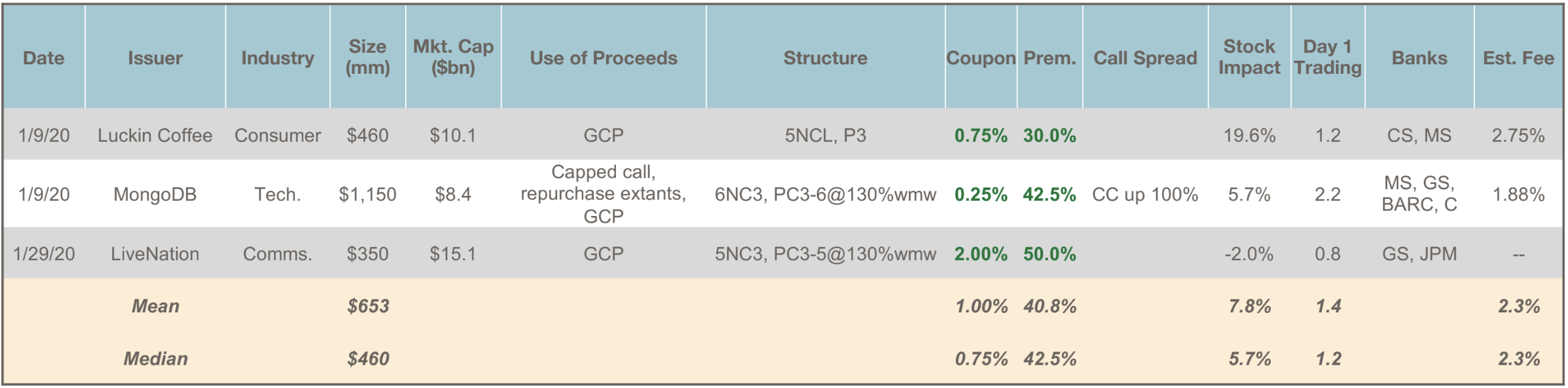

- Trends: January’s MongoDB deal continued the trend of convertible issuers from the last 2 years conducting new offerings to refinance and extend the maturity of their balance sheets, while taking advantage (especially in tech) of meaningfully higher equity valuations and convertible market conditions.

- Total Issuance: After a busy 2019, the new year got off to a relatively slow start, with $2 billion of new convertible debt pricing in 3 deals. January 2019 was similar (only 2 deals) as markets were still recovering from their December 2018 swoon, while January 2018 was quite busy with 10 deals pricing starting after the 11th of the month. While many issuers were in blackout during the first half of the month, activity notably did not pick up in the second half, as market conditions were choppy with news of impeachment and 2019 Novel Coronavirus.