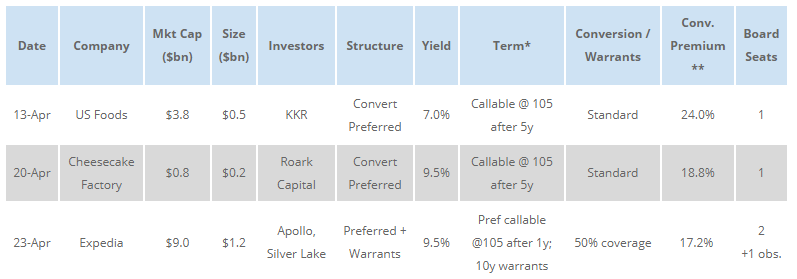

In the last several weeks, we have seen companies in the sectors most directly affected by Covid-19 (consumer/retail, travel) access the private markets through PIPE investments (Private Investment in Public Equity), as well as the public equity and equity-linked markets. The table below summarizes the terms of three recent PIPES.

**Conversion premium measured by comparison to last closing price prior to deal announcement.

The terms in the above transactions are optically expensive:

- In U.S. Foods, paying 7% for 5 years effectively reduces the 24% conversion premium by 35%, resulting in an effective ~19% discounted equity issuance.

- Similarly, 9.5% for 5 years creates an effective 38% discount on equity for CAKE

- In the case of Expedia, while 9.5% seems to be a reasonable yield on preferred stock given their 10-year debt trades at ~6%, the 10-year warrants are worth at least an additional $230 million (conservatively assuming 40 vol), effectively pushing the yield on the preferred above 15% assuming a 5-year period.

The high cost of capital is expected in a PIPE context, as private capital generally has higher return hurdles than public market funds. It can be rational for companies to incur this cost in several circumstances: (1) if a company believes the strategic imprimatur of a high-profile investor will inspire public market confidence in the business / management team, (2) private investor joining the board will enable restructuring or operational changes not possible previously and (3) access to cheaper public market capital is unavailable or highly uncertain.

While individual companies’ strategic positioning can differ, we note that the Covid-19 situation is extremely challenging market-wide, and, as such, there may be less of a need for a strategic investor halo than in a situation where a particular company experiences a scandal or operational stumble relative to a healthy marketplace.

As to access to public market capital, the situation was indeed challenging in late March and the beginning of April: Carnival Corp sold equity at a 38% file-to-offer discount and a concurrent 3-year convertible bond at 5.75% coupon up 25%.

However, since then public market access has improved considerably. Recent equity deals in these sectors were:

- 14-Apr: Dave & Buster’s (~$400mm mkt cap): $75mm ATM at a ~13% file-to-offer discount

- 15-Apr: Performance Foods (~$3.0bn mkt cap): $304mm follow-on at a ~6.3% file-to-offer discount

- 17-Apr: Shake Shack (~$1.5bn mkt cap): $150mm ATM + follow-on at a ~4.5% discount

- 20-Apr: Darden (~$7.0bn mkt cap): $458mm follow-on at ~5.3% discount

- 21-Apr: United Airlines (~$6.0bn market cap): $1.0bn follow-on at ~5.0% discount

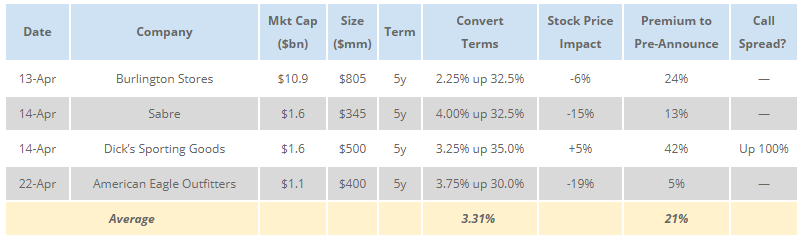

Similarly, in the convertible market, issuers are achieving reasonable terms with reasonable (relative to size of market cap) stock price dislocations:

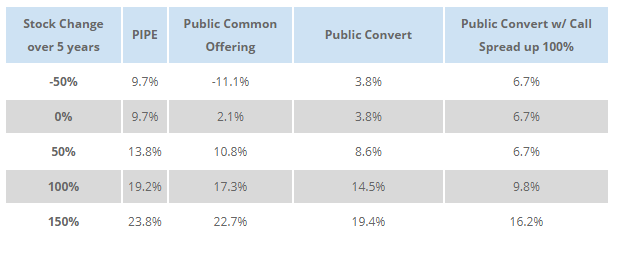

The average terms of these convertible bonds have effective conversion premiums (even taking into account the stock price dislocation) similar to the PIPEs, significantly lower yields, and no governance issues to contend with. Below we examine the 5-year cost of capital of these various alternatives, taking into account a 10% stock price dislocation on the public alternatives.

Public common and convert offerings assume 10% dislocation from undisturbed stock price. Public convert terms are 3.75% up 30%, with call spread up 100% costing 12% of par.

The above analysis shows that in current market conditions public market transactions tend to be superior from a quantitative perspective (cost of capital) as well as a qualitative one (lack of governance). Therefore, an issuer must place high value on the potential signaling or operational benefits to justify raising capital through a PIPE.