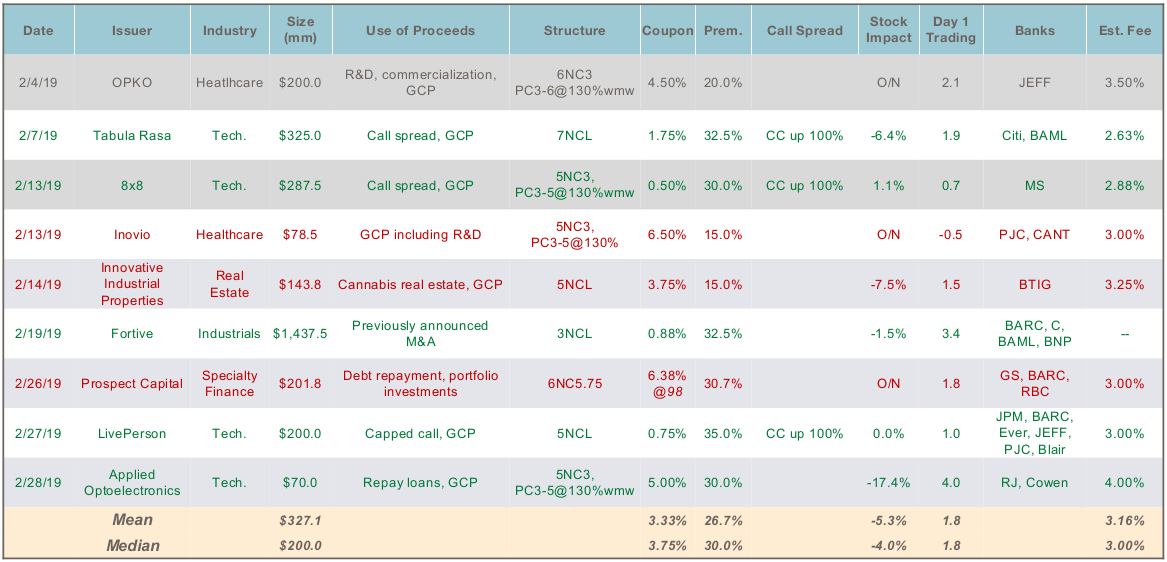

- Total Issuance: February new issue activity recovered from December and January, with 9 deals for a total of $2.9 billion, of which half was the $1.4375 bn Fortive deal. The YTD total now stands at $3.9 billion (11 deals), compared to $4.2 billion (15 deals) through February of last year.

- Investment Grade Opportunity: Of particular note was the Fortive (rated BBB/Baa1) offering of 3 year converts which priced at 0.875% up 32.5%. The pricing terms reflected the scarcity of investment grade rated convertible paper. Investors were willing to pay 100 for a security that was worth ~99 on reasonable credit and volatility inputs. The bidding continued in the aftermarket as the bonds traded up more than 3 points. Potential investment grade issuers should note that in view of the relative lack of IG-rated paper, there is an opportunity to sell convertible bonds with low equity risk at terms significantly better than those available in the credit markets proper.

- Market Inputs and Terms: Inputs have mostly normalized from their dislocated posture in December-January. BB spreads are now only 15 – 25 bps higher than last summer. Similarly, the market is valuing small-mid cap tech/software credit spreads in the L + 300 – 350 area again (e.g., 8×8 and LivePerson), compared L + 300 or slightly tighter mid-2018.

- Risk Transfer: Of the 9 February deals, three were executed overnight. Although this was in some cases accompanied by a wall-cross pre-marketing process, it makes clear that the market is again open to pricing and bearing stock dislocation risk.