In a previous post, we analyzed the trend of drawing down on credit facilities to enhance liquidity during the COVID-19 crisis. In a similar theme, many companies are also reconsidering their capital return programs.

We quantified the number of companies that have announced the suspension of ongoing share repurchase plans. To do this, we algorithmically scraped all EDGAR 8-K filings, from February 15th to March 27th, for announcements of share repurchase suspensions. Over this period, we found that 65 U.S. companies filed an 8-K announcing the suspension of their programs. However, we also found that some companies announced suspensions verbally or through press releases that were not also filed on an 8-K (e.g., McDonald’s and many of the large banks). When we add these announcements to the algorithmic results, we get a total of 81 U.S. companies.

To put this into perspective, these 81 companies repurchased ~$178bn¹ of stock during 2019.

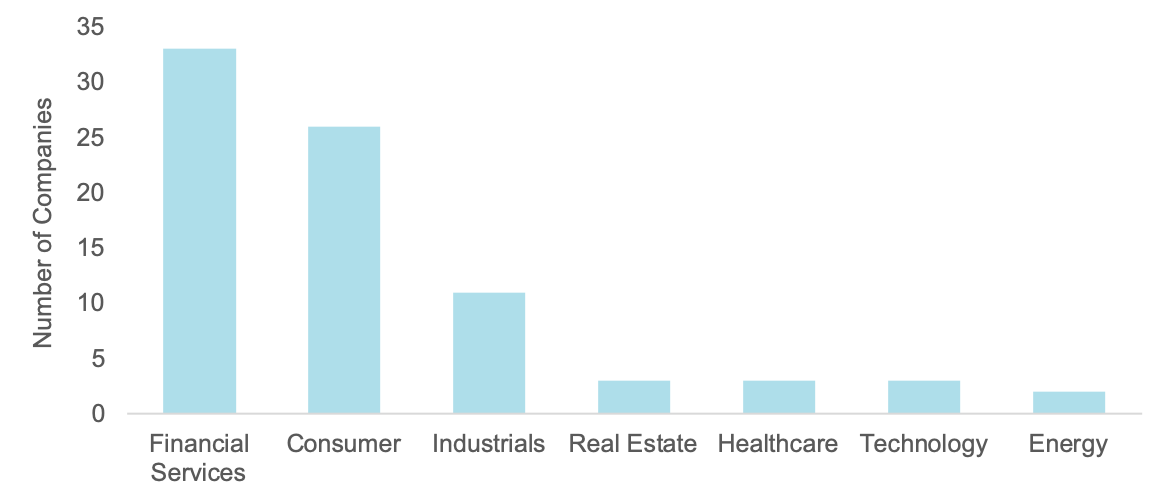

The chart below shows the number of companies in each industry sector that have suspended its share repurchase program:

The high proportion of Financial Services and Consumer companies are to be expected; however, the data also shows Industrial companies are concerned about their excess capital positions as well.

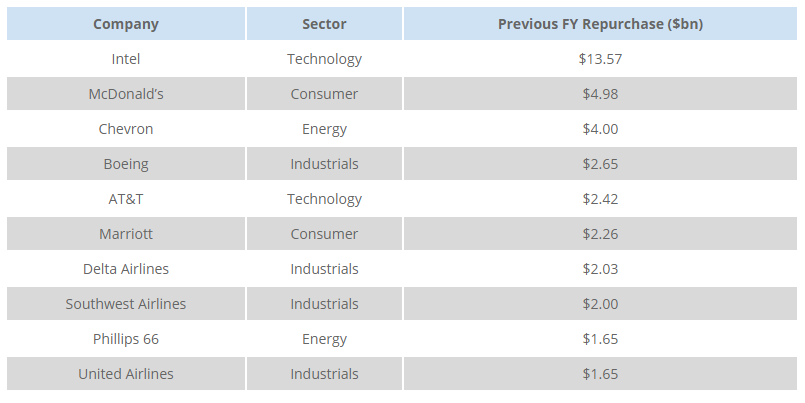

The table below lists the 10 largest non-Financial Services suspensions, ranked by amount of stock repurchased in the previous fiscal year.

We will continue to monitor the capital return environment and provide updates.

¹ Source: Thomson Reuters for most recently completed fiscal year