In a previous post, we analyzed the trend of suspending share repurchases to preserve liquidity during the COVID-19 crisis. In a similar theme, many companies are also now reconsidering their dividend programs.

We quantified the number of companies that have announced the reduction or suspension of their future dividend plans. To do this, we algorithmically scraped all EDGAR 8-K filings from March 1st to April 9th for announcements of dividend reductions or suspensions. Over this period, we found that 101 U.S. companies filed an 8-K announcing the reduction or suspension of their dividend. Within those 101 companies, 55 have completely suspended their dividend.

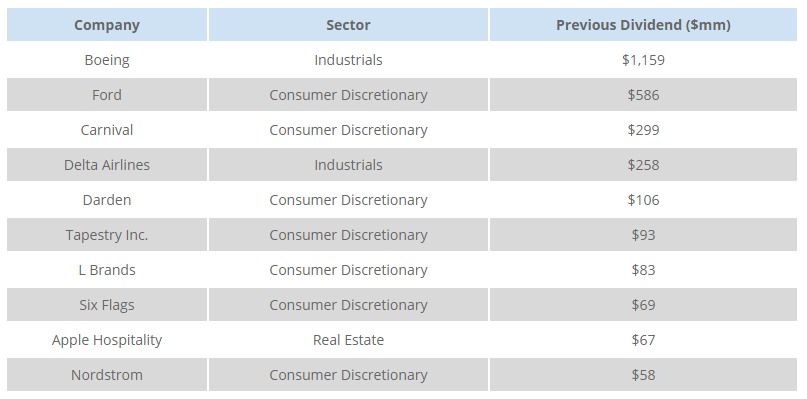

To put this into perspective, these 101 companies paid out ~$5.2bn¹ in total dividends during their last fiscal quarter.

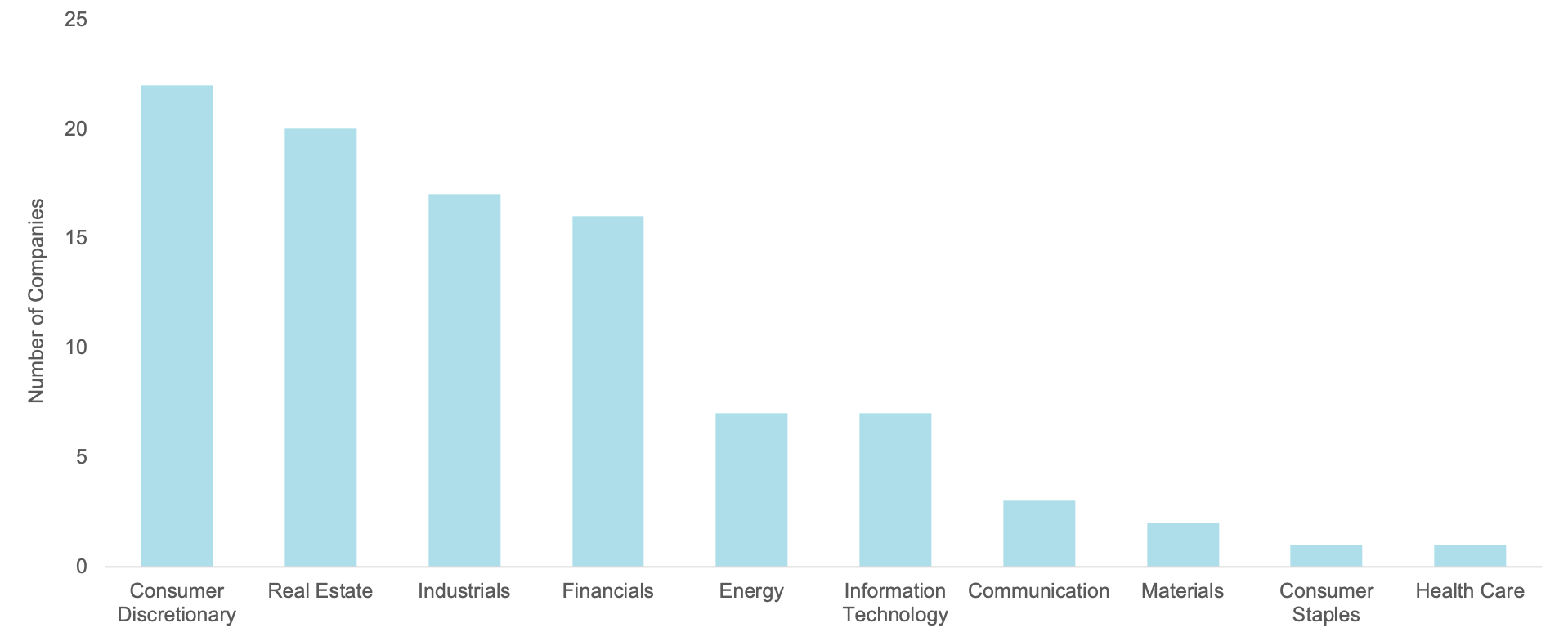

The chart below shows the number of companies in each industry sector that have reduced or suspended its dividend:

The high proportion of Consumer companies is to be expected; however, the data also shows Real Estate, Industrial and Financial companies are concerned about their capital return programs as well. Unsurprisingly, as seen in our previous post, these four sectors also had the greatest number of share repurchase suspensions (albeit in a different order).

The table below lists the 10 largest suspensions, ranked by the aggregate value paid out to investors during their last fiscal quarter.

We will continue to monitor the capital return environment and provide updates.