Since April, the U.S. market saw a total of $33 billion of convertible debt issued in the U.S. primary market across 65 deals, almost as much as the full-year totals for both 2018 and 2019 ($41 and $42 billion, respectively).

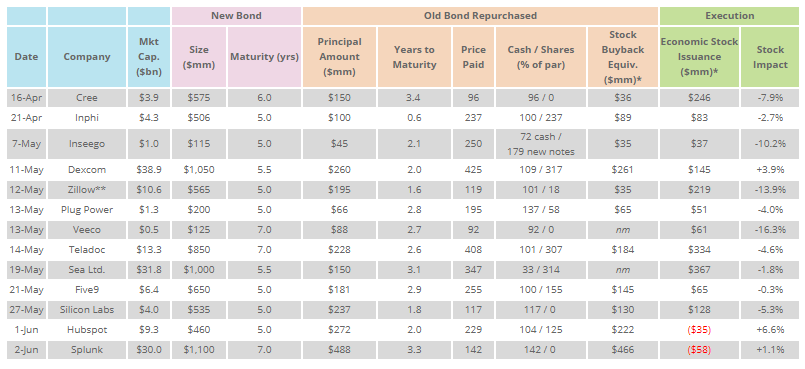

During this period, 13 issuers repurchased existing convertible notes concurrently with the offering:

**Zillow was offered with a concurrent equity deal

There are a few patterns of note in this activity:

- Convertible Refinancings Are Occurring Earlier. Traditionally companies look to refinance 12 to 18 months ahead of an upcoming maturity. Given the significant economic risks that lie ahead, companies are choosing to de-risk the balance sheet by refinancing earlier. 10 of the 13 transactions had 2 or more years to maturity.

Seven of the transactions involved the refinancing of deep-in-the money bonds (bond price > $200). It is common for issuers to refinance these bonds (almost irrespective of time remaining to maturity) because they pose two challenges: 1) these bonds now have an expensive equity cost of capital in upside scenarios and 2) the increased risk of early conversions makes the original capital raised less usable. - Stock Price Impact. The need for arbitrage investors in the old bonds to cover their short hedge can offset new investors’ shorting activity; similar to a concurrent stock buyback or use of a call spread, this reduces pressure on the stock. If the old bondholders are long-money investors, those investors’ purchase of the new bonds with proceeds from the old also eliminates shorting activity. In about half the deals listed above (IPHI, DXCM, PLUG, TDOC, FIVN, SLAB), this dynamic represented a meaningful offset to selling pressure on the new deal. These deals had an average stock price impact of 2.2%, compared to 7.3% for all deals since April.

If the quantity of old bonds purchased (for cash) is large enough, the amount of short covering by holders of the old bonds can actually exceed the amount of selling by new investors. The result can be net upward pressure on the stock price. In cases where the transaction is an economic net share repurchase, the stock price increase actually worsens the company’s overall economics (the increase in buyback price more than offsets the gain from a higher conversion price on the new bond).

We observed this dynamic in the Hubspot deal. There, the buying activity from the bond repurchase was so much greater than the shorting caused by the new issuance, that the stock price closed up 6.6%. While this is usually a good thing when issuing a convertible, after taking into account the up 32.5% conversion premium and up 100% call spread, the amount of equity economically sold by Hubspot in the offering was ~$156mm. This was ~$35mm less than the amount of equity implicitly purchased by the company in the cash component of the buyback (also adjusted for the old call spread unwind). Thus the unbalanced buying activity on a net basis made the transaction more expensive for the company overall.

We have written about this counter-intuitive value loss before. There are many structuring alternatives that companies can implement to avoid this: issuance of more bonds, managing the hedge / outright allocation mix carefully, or adjusting the cash / stock exchange mix.

Please reach out to Matthews South for an independent, data-driven assessment of market conditions and terms achievable to issuers in the market.

Related Articles