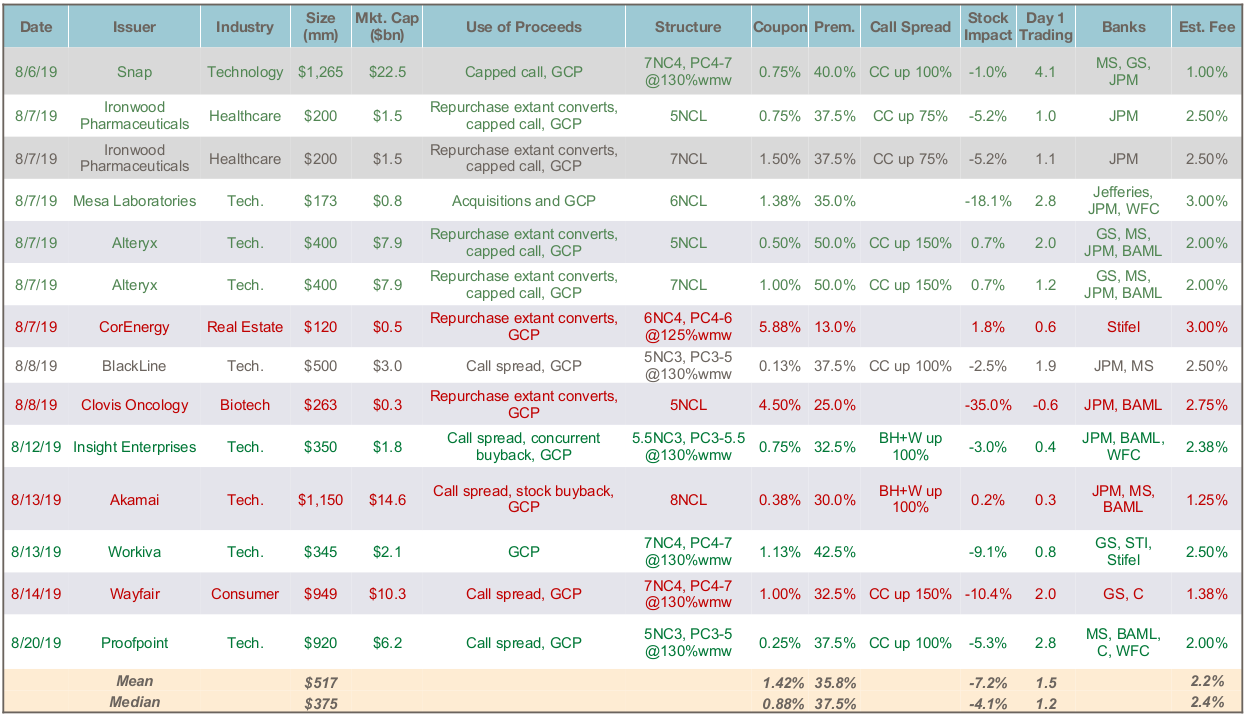

- Total Issuance: Activity picked up significantly in August, with $7.2 billion of convertible bond issuance over 12 transactions. This makes August the busiest month of 2019, and brings the YTD total issuance to $26.9 billion, versus $32.1 billion in 2018 through August.

- Market Dynamics: August did see greater market choppiness with an inverted yield curve signalling elevated recession risk, and continued U.S.-China trade conflict. A number of “risk off” days resulted in the delay of several deals, and several deals saw significant stock price impacts during marketing or investor-friendly terms. Marketed deals in August saw an average -7.2% stock price decline vs. -5.1% for the YTD average. We expect the market to remain open but issuers should be patient about choosing a good day in the market.

- Bond Buybacks: Repeat deals from companies who issued bonds in the last 18 months have been frequent and a number of these companies have bought back meaningful portions of their old convertible bonds. The bond buyback mitigates future dilution risk and refinances the balance sheet. In addition, the repurchase of the bonds offsets technical selling pressure from hedge fund investors during the marketing period. Alteryx, for example, bought back more than half its in-the-money converts sold in 2018, and saw a 0.7% stock price increase during marketing.

- Call spreads: Up 150% upper strikes for call spreads continue to be executed with frequency and efficient pricing. This can be especially attractive for 7 year bonds (e.g., Alteryx and Wayfair) given the increased equity price exposure on longer-dated paper.