Over the past five years, Matthews South has advised clients on over $30 billion of ASR transactions. As a result, we have collected a large amount of data on achieving the best pricing for ASRs. In this write-up, we “open source” our findings so that all ASR issuers may benefit from what we have learned.

Have Matthews South clients achieved better pricing?

Our insights on getting the best terms are only valuable if we can first provide you with empirical evidence of the pricing success our clients have achieved.

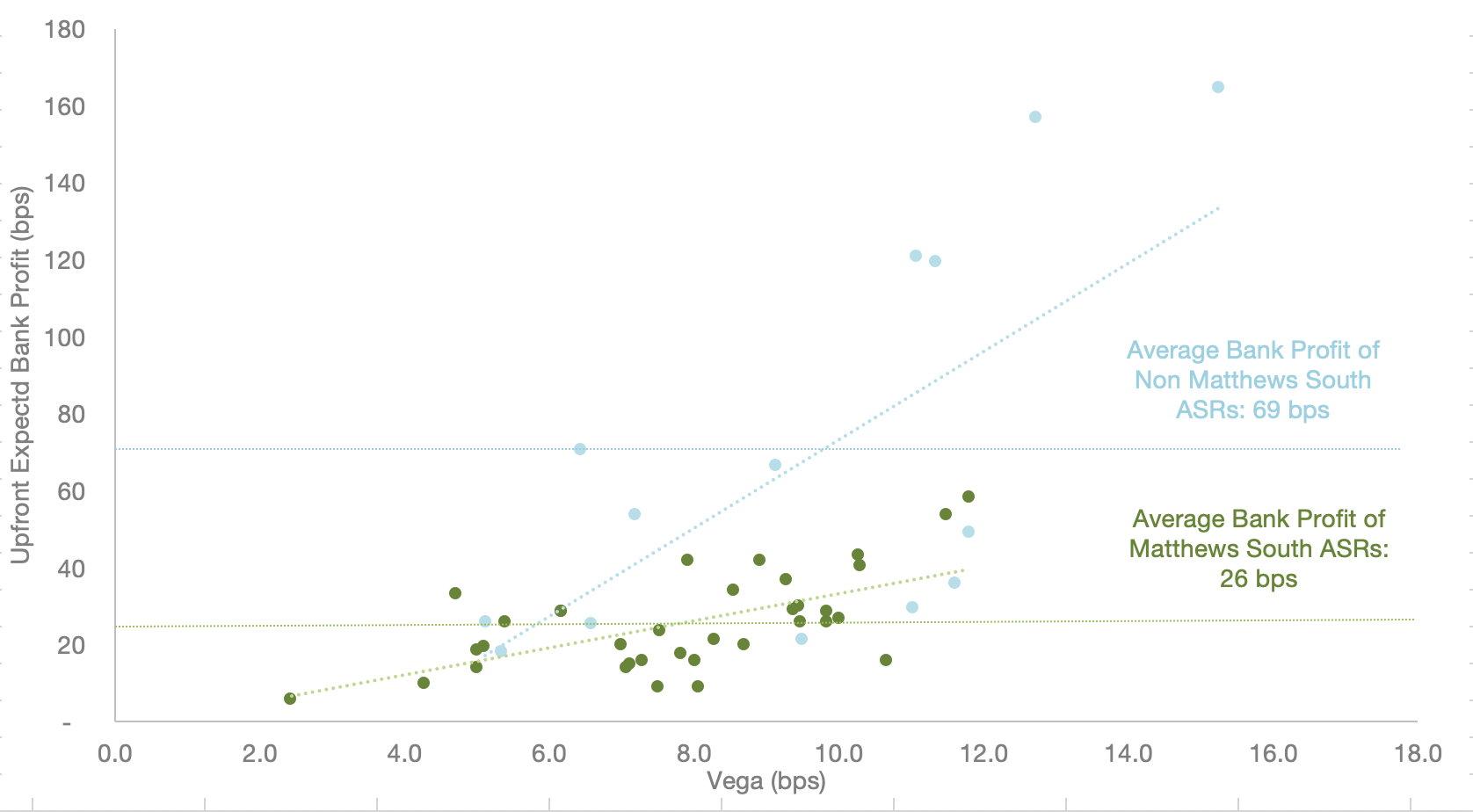

We did a study, for the period 2017 to now, where we compared ASRs that we advised to ASRs that we did not advise but for which the relevant issuer had provided us with all the trade details. We used our software application (which our clients can access through our website) to calculate the bank’s upfront expected profit and volatility risk (vega) for each ASR. Correlating profit with vega allows us to normalize for the different amount of volatility risk in ASRs analyzed. For example, riskier ASRs should naturally trade with higher upfront bank profit and vice versa.

The data shows that on average, banks made 43 bps higher profit on transactions that Matthews South did not advise. In uncollared ASRs, there is a 1-for-1 relationship between upfront bank profit and VWAP discount. This means that Matthews South advised clients, on average, achieved a 43 bps higher VWAP discount.

How do our clients achieve better pricing?

The fundamental challenge with ASRs is that their pricing is opaque. In every other corporate derivatives market (e.g. rates, fx, commodities), there are many sources for mid-market information. In trading an ASR, without access to the mid-market VWAP discount, an issuer is essentially blind to the actual cost of the product.

Our software application is the only third-party tool available that provides mid-market pricing on all ASR structures. With this transparency and our historical bid database, Matthews South can provide clients with the “fair profit” VWAP discount level. Our clients leverage this information regardless of their process for awarding the ASR: negotiated, narrow auction or broad auction.

- Negotiated: this is the most obvious use case where the lack of a price discovery process makes knowledge of the “fair profit” level valuable. Armed with “fair profit” level, our clients can award the ASR to the chosen bank without an auction but have confidence that the pricing was fair.

- Narrow Auction: many issuers have limited price discovery because they choose to limit the auction to their lending bank group. This group may naturally be small in number, may include banks that are not competitive and may also exclude competitive banks. Knowledge of the “fair profit” VWAP discount, allows our clients to ask the winner of the auction to match the “fair profit” level if their bid is lower.

- Broad Auction: knowing the “fair profit” discount allows issuers who bid their ASRs broadly to add an important final step to their process. If the winning bid is lower than the “fair profit” discount, they can ask the winner to improve to that level. This last step is valuable because it ensures that every ASR will be traded at an objectively fair price and not just the best relative price of an auction.

Other important process enhancements

We have also found that running a crisp process can be helpful to achieving best pricing:

- Confirms with all counterparties fully negotiated ahead of time

- Bid sheet is very detailed (e.g. includes a full list of observation dates, etc)

- Final bids are due right after market close and client executes that evening

- Delaying time from bids due to actual trade date creates optionality for the winner–for example if volatility increases over that period, the winner will not automatically improve the VWAP discount