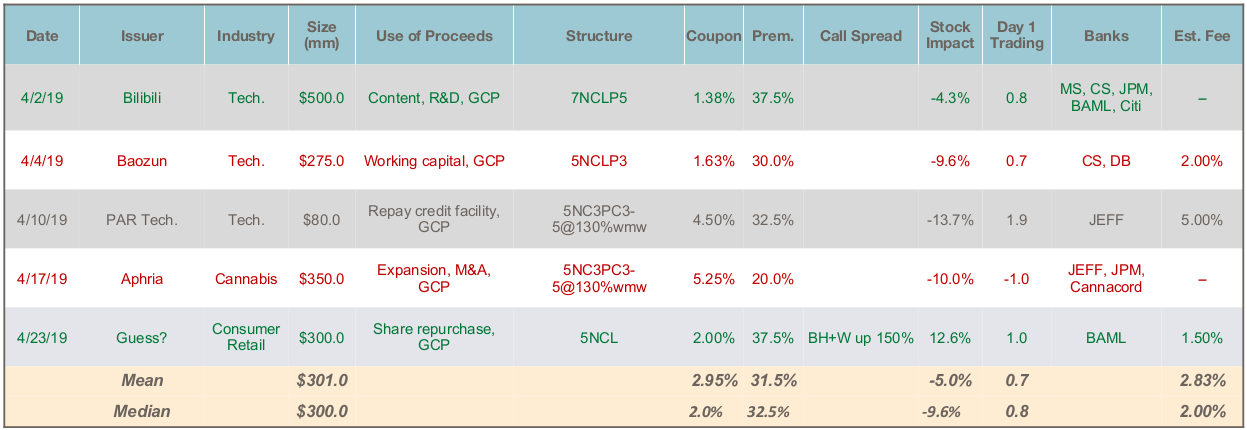

- Total Issuance: April was typically quiet, with most U.S. issuers in blackout for several weeks. There were 5 convertible bond deals for a total of $1.5 billion. Bilibili and Baozun continued the trend in the past year of Chinese-based tech companies accessing the market. Year-to-date total now stand at $10.1 billion issuance over 23 deals, compared to $12.1 billion in 35 deals in the first 4 months of 2018.

- High-Strike Call Spreads: Notably the Guess? transaction (on which we advised) contained a call spread with an upper strike of 150%. Strike prices are typically either at a 100% premium (52% of call spreads since 2017) or lower (41%), but higher strikes are increasing in frequency. Since November 2018 there have been four such deals: Wayfair (150%), BenefitFocus (120%), Guess? (150%) and Tesla (150%). Pricing has been generally efficient to the extent a robust competitive process is run, as different banks have different levels of risk appetite for these types of structures.