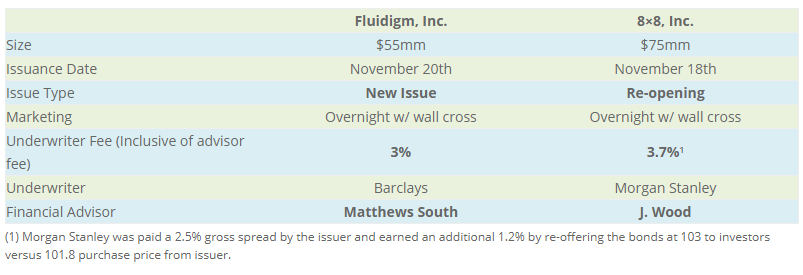

During the week before Thanksgiving, the coincidental execution of two convertible bond transactions provided a classic “A/B” comparison that highlights the variability in fees paid by issuers and the important role of the financial advisor in this regard.

What is a typical fee for sub-$100mm deals?

The average fee for a $100mm (or lower) new issue convertible since 2016 is roughly 3.7%. By this measure, 8×8 paid an average fee, while Fluidigm achieved a nearly 20% reduction. However, it is incorrect to compare 8×8’s fee to the new issue fee precedents because its financing was a re-opening. When compared to other re-openings over the past two years, 8×8’s fee stands out as the highest paid.

What is a re-opening?

A re-opening is an issuance that increases the size of a previously issued convertible bond. In the case of 8×8, the company had issued a $287.5mm convertible in February 2019. In the November financing, 8×8 issued an additional $75mm of the February bonds thereby increasing its total amount outstanding to $362.5mm.

A re-opening is used when an issuer seeks to raise a small amount of additional capital in an efficient transaction. The efficiency stems from the fact that the re-opening 1) reuses all the original documentation, 2) leverages current trading price of existing issue for pricing transparency and 3) does not require a broad marketing effort since existing holders of the original bonds typically buy all the re-opened bonds. As a result, almost all re-openings are executed on an overnight basis and priced at a modest discount to the existing bonds.

How does a re-opening fee compare to a new issue fee?

The underwriting fee for re-openings are generally significantly lower than those for new issues. There is no structuring or documentation work for the underwriter, pricing is just a discount to current observable trading price and the marketing is generally limited to the existing holders. The low work effort required is supported by the fact that the mean and median fees for re-openings over the past two years are 1.7% and 1.5%, respectively.

In June 2019, Morgan Stanley led a $75mm re-opening for New Mountain Finance Corp. for a 0.50% gross spread.

The fact that 8×8 paid a higher fee for the re-opening than the original deal (3.7% vs 2.875%) is highly unusual and counterintuitive.

Role of the Financial Advisor in Underwriter Fee Negotiations

A financial advisor plays a critical role in helping issuers with the underwriter fee negotiations. The advisor can independently help the issuer understand the precedent fees for the correct comparable transactions (e.g. new issue versus re-openings) and use a competitive process to lower the underwriting fee paid.

Matthews South has a track record of helping issuers pay materially lower fees than precedent transactions.