CAESARS. Dragons. ZcallS. YEPS. Give derivative marketers a simple product and they will come up with a million names and a lot of dressing up.

This blog post explores a simple put option sale (a.k.a. CAESARs, Dragons, ZcallS, and YEPS) and its role in a corporate share buyback plan, especially in the current environment.

What is a Prepaid Put?

With a prepaid put, the issuer sells a put option on its own stock to a bank and owes the present value of the strike price upfront (vs. at exercise in most put options). The bank owes the issuer an option premium for the put option and the prepayment amount is also discounted for the time value of the strike price being paid up front. These amounts are netted for a single reduced payment by the issuer after entering into the transaction. The issuer selects the maturity and strike price.

At maturity, if the stock price is greater than the strike price (the put option is “out-of-the-money”), the company will receive the strike price back (i.e., including the option premium and accreted value of the cash paid up front).

If the stock price is less than the strike price, the bank will put the stock to the company with no further payment by the company. Effectively, the company buys such shares at a price equal to its initial payment.

What is its Role in a Share Repurchase Program?

A prepaid put is a cash management and share management tool. If the stock appreciates, the issuer receives a meaningful return on its cash (due to option premium and returns earned on cash). If the stock declines below the put strike, the company receives shares at a significant discount to the price at which the issuer entered into the program.

In this way, the company is monetizing its willingness to buy stock at a discount to the market price in order to get a meaningful cash return or retire stock at a meaningful discount. It is worth noting that the return on cash earned in the program is usually tax-free because it is related to a transaction in the issuer’s own stock.

Unlike an ASR or open market purchases, the prepaid put does not guarantee the retirement of stock. Shares are only retired if the stock price is below the put strike at maturity or otherwise elected at maturity. So, this approach should only be a portion of an overall share repurchase program.

Pre-paid puts can underperform if the stock price declines by more than the expected return earned. In these cases, the issuer would have been better off waiting and buying the shares in the open market at the lower price.

Why Now?

The market is at a unique time of high volatility combined with a significant decline in share prices. The high volatility means that issuers can generate meaningful premium selling puts on its stock. The lower equity valuation increases the attractiveness of selling puts because, in the event that it retires stock, the company will buy stock at a discount to the already discounted equity prices.

As an example, let’s assume a well known mega cap company sells 6 month, 95% strike puts. If the company had done this a year ago, the volatility used to price the option would be 30.9%. In the current environment, its volatility is 35.5% (4.6pts higher).

A year ago, this would have generated a 14% annualized return ($6.8mm on $100mm upfront payment). If the company received shares, it would have retired stock at an 11% discount to when it entered into the program.

Currently, this will generate a 17.8% annualized return ($8.5mm on $100mm upfront payment). If the company receives shares, it will retire stock at a 12.5% discount to when it entered into the program.

In other words, the company monetizes volatility and sees this through a high return on cash if the put is out-of-the-money or a repurchase of stock at a meaningful discount to already discounted prices.

What Does Pricing Look Like?

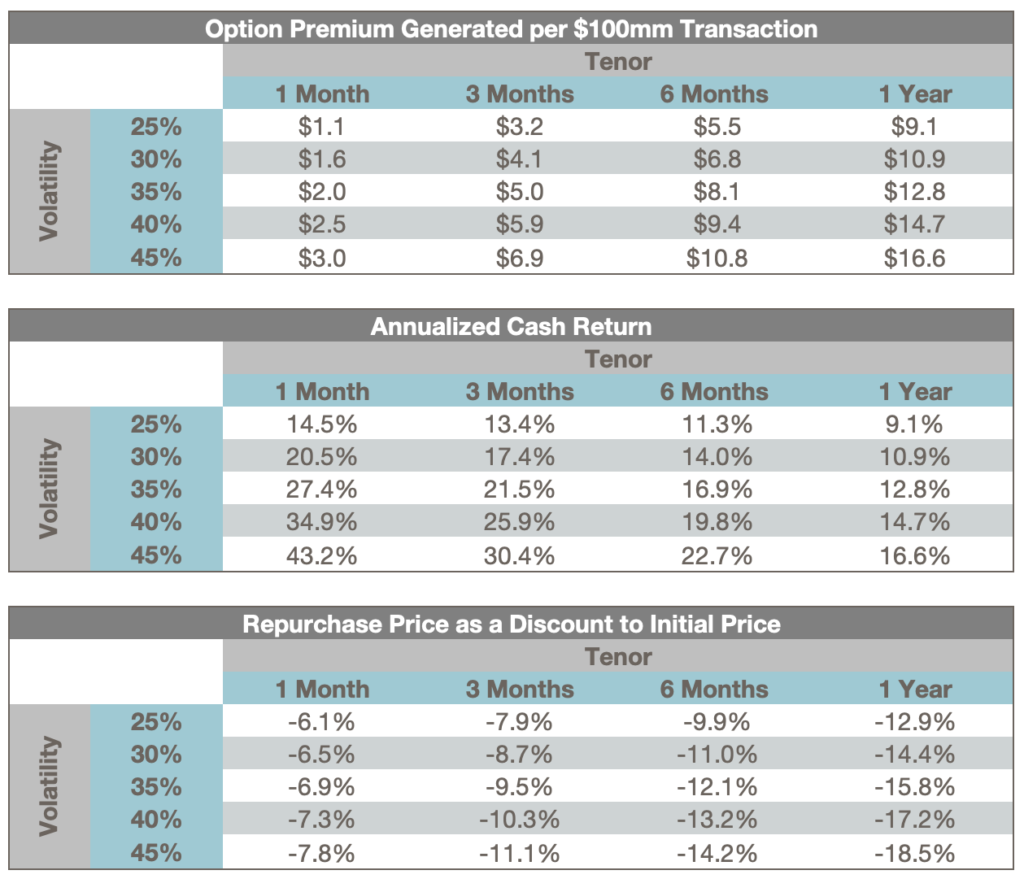

To give you a sense of the pricing, we created the table below, looking at volatility vs. tenor. All pricing assumes a 95% strike price.

Conclusion

For an issuer that has a share repurchase program, pre-paid puts provide an attractive cash management option for the willingness to buy shares at a significant discount to the current price. The current market environment of high volatility and lower equity prices makes this strategy an attractive option to consider.

Please reach out to the Matthews South team to learn about the benefits and considerations of this strategy.

Personal Views: The views expressed in this report reflect our personal views. This blog post is based on current public information that we consider reliable, but we do not represent it is accurate or complete, and it should not be relied on as such. The information, opinions, estimates and forecasts contained herein are as of the date hereof and are subject to change without prior notification. The large majority of reports by us are published at irregular intervals as appropriate in our judgment and ability to produce, so updates may not be made or available even when circumstances may have changed.

No Offer: This analysis is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. It does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. You must make an independent decision regarding investments or strategies mentioned on this website. Before acting on information on this website, you should consider whether it is suitable for your particular circumstances. You should not construe any of the material contained herein as business, financial, investment, hedging, trading, legal, regulatory, tax, or accounting advice. The price and value of investments referred to in this analysis and the income from them may fluctuate. Past performance is not a guide to future performance, future returns are not guaranteed, and a loss of original capital may occur.