An issuer must be free of any material non-public information (“MNPI”) at the time of a securities offering. In the ordinary course, the most likely source of MPNI is information about business performance since the last earnings announcement. As an issuer gets later into the quarter or is in the period between quarter-end and the earning announcement, there is heightened risk that the issuer may be in possession of MNPI.

It is common practice for an issuer to use employee trading windows (“blackout periods”) as presumptively applying to the company as well when executing securities transactions (e.g. convertible issuance or share repurchase). In this post, we seek to examine how frequently companies issue convertible bonds in the typical “blackout period” of the quarterly cycle.

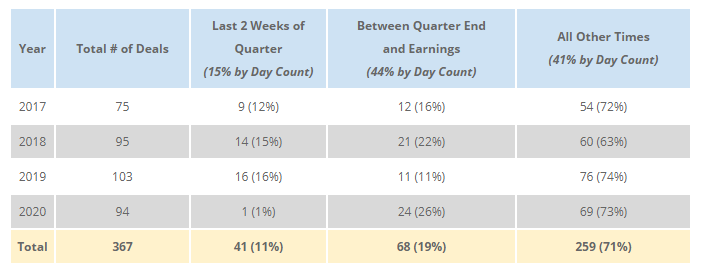

Quarterly blackout periods vary by company. But it is possible to examine the frequency of deals that happen either (1) after quarter end but before the next earnings release and (2) in the last 2 weeks of a fiscal quarter. For the universe of U.S. convertible deals since 2017, we examined the timing of each deal relative to that issuer’s fiscal quarter end dates and earnings release dates.

We see several patterns from this:

- Deal activity remains active during the last 2 weeks of companies’ fiscal quarters. On average 11% of deals occur during this period which represents 15% of the year by day count. However, this statistic was impacted by COVID-19 shutting the market during March 2020. Excluding 2020, ~14% of deals occur during this period; essentially pro-rata for the number of days.

- Deal activity is disproportionately slow during the core blackout period between quarter end and earnings. While this period on average represents ~44% of days in a quarter (somewhat longer after FYE), only 19% of deals occur in this period. In 2020, this period was unusually busy as companies sought to raise capital during April after markets recovered from the March COVID-19 selloff.

However, 19% of deals is still a meaningful number, and below we drill a bit deeper into the timing and disclosure practices around deals in this period. - Finally, as expected, during the core open window of each quarter (between earnings and 2 weeks before the next quarter end), there is disproportionate deal activity–70% of deals happen in this 41% of the year.

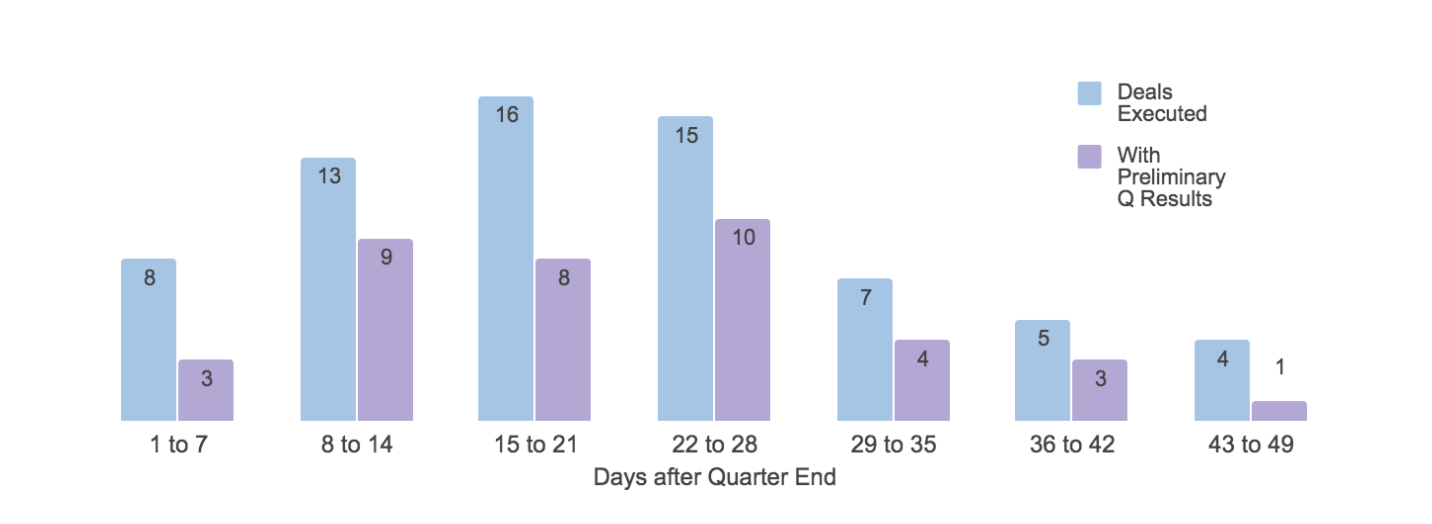

Within the universe of deals executed between quarter-end and the next earnings release, the chart below plots how long after the end of the quarter they occur. There is no clear trend: deals can be and are executed throughout this blackout window. The relatively lower number of deals in the first 7 days after quarter-end is driven in part by the fact that for many companies, the holiday weeks containing New Year’s Day and the 4th of July fall during this period. The relatively lower number beyond 28 days is driven by the fact that, except for Q4, companies typically report earnings roughly a month after quarter-end.

Of these 68 deals, 38 (56%) reported preliminary quarterly results (ranging from quarter end cash balances for companies with minimal revenue / income, to revenue ranges, to more complete estimated results as earnings dates approach). This practice was relatively less frequent in the first week after quarter-end, when these results are less likely to be available. In Q2 2020 (especially April), the numbers were largely similar, with 20 out of 30 companies pre-releasing results for the recently completed quarter, often in addition to COVID-19 updates providing some guidance for future periods.

Among the 30 companies that executed transactions without providing preliminary results, a disproportionate number were Biotech companies (5 deals), for whom quarterly financials are less relevant than drug development milestones, and investment vehicles like REITs or BDCs (7 deals) where somewhat static investment portfolios can generate less variable quarter-to-quarter financial results. That said, the remaining 18 deals were across a variety of sectors, including Technology and Communications (6 deals), Industrials (4 deals), non-Biotech Healthcare (4 deals), and Energy / Natural Resources (4 deals).

Conclusion

Our survey of convertible financings since 2017 shows relatively high frequency of deals happening during typical corporate blackout periods. The result is surprising given the default assumption that companies should avoid securities transactions during this period. Interestingly while a majority of companies that did deals in this period did provide additional disclosure, a significant percentage did not.

Related Articles