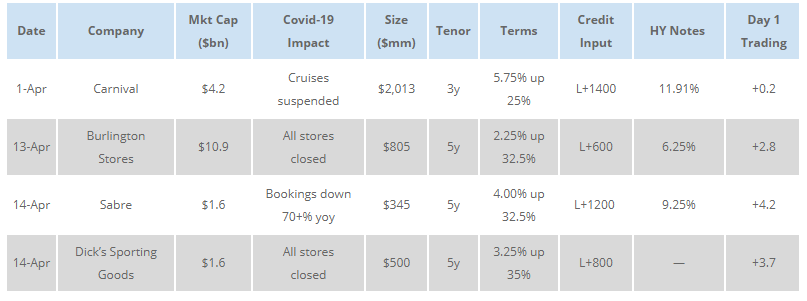

Last week, the convertible market was very active with 6 new issue transactions totalling $2.6 billion in issuance. Three of the issuers were from sectors that have been deeply impacted by the Covid-19 pandemic: two in retail (Burlington Stores and Dick’s Sporting Goods) and one in travel (Sabre). All three deals priced on the issuer-friendly end of the range and traded well day 1. The terms were also markedly better than those achieved by Carnival Corp just two weeks earlier. Below is a list of deals in these directly-affected sectors:

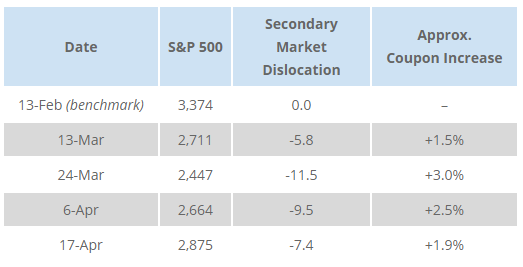

This improvement parallels improvements in the convertible secondary market, which we have been tracking (for a universe of bonds issued between 1-Aug-19 and 1-Feb-20) throughout the Covid-19 period:

The convertible market has recovered significantly from its late-March trough and is now open for many classes of issuers, including those in sectors most impacted by the pandemic.

If you are considering an issuance, please reach out to Matthews South for an independent, data-driven assessment of the terms that are achievable in the market.