The new issue convertible market got a notable data point with the offering for Slack Technologies, which priced a $750 million 5-year offering after the close Monday.

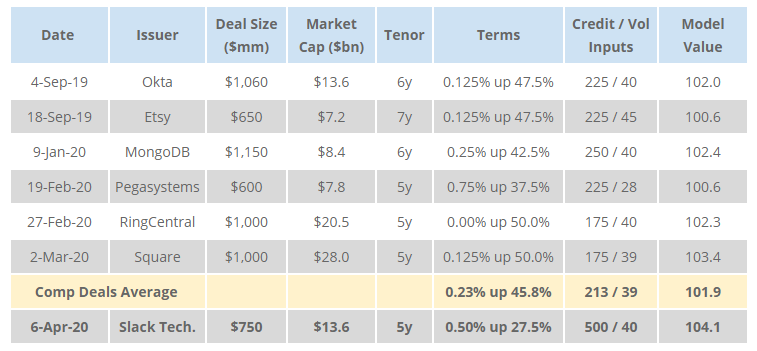

The deal priced with a 0.5% coupon and 27.5% conversion premium. The transaction was marketed with a L + 500 bps credit spread / 40% volatility. While these terms are optically more attractive than prior week’s two deals, we think it is more instructive to compare them to other large-cap tech deals from the last several quarters. Below is a list of new issuance for U.S. tech companies with market capitalization of at least $7 billion since September:

The terms Slack achieved were worse than what peer companies achieved prior to the Covid-19 shutdown in the convertible market. This worsening is consistent with the secondary market sell-off in convertibles.

The Slack bond traded up ~3.5 points, stock adjusted, on Tuesday. This validates the credit and volatility inputs and model value. It is notable that the market is now using a +500bps credit spread assumption versus the +213bps peer average pre-Covid. This implies that Slack could have issued a 0% coupon up 52.5% conversion premium bond (102.5 model value) with pre-Covid assumptions.

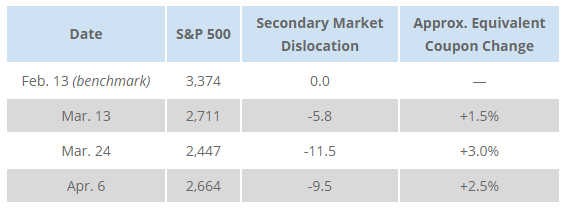

We have also updated our prior analysis that tracks the dislocation of convertible market trading (for a universe of bonds issued between August 1, 2019 and February 1, 2020). This analysis shows that the market, while still dislocated, had improved slightly from its March 24th low — and the +2.5% coupon estimate below is consistent with the observed change in Slack assumptions and terms.

Please reach out to Matthews South for an independent, data-driven assessment of the terms that you can achieve in the market.