Highlight: The convertible market has continued to weaken since March 13. By our calculations, expected new issue coupons are now 3% higher than in mid-February and 1.5% higher than on March 13.

In a previous post, we examined the impact of the current volatile market conditions on potential terms for new issue convertible bonds. With the primary market for convertible issuance closed since the first week of March, the secondary market remains the best source of data for making this assessment.

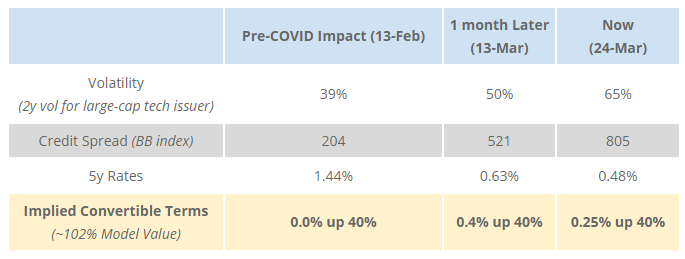

Simple Model for Comparative Convertible PricingAs before, we begin with the simplistic model of using the basic inputs of convertible pricing: volatility, credit and rates. For consistency, we show the inputs and implied convertible terms from 13-Feb (prior to the market impact of Covid-19), one month later (from our last post) and now (24-Mar).

This analysis implies relatively stable terms in the convertible market, with the increase in volatility and rally in rates offsetting the sharp sell-off in credit.

Secondary Market Analysis

Once again, we believe that this simplistic model does not incorporate the elevated risk premium required by investors in times of high uncertainty.

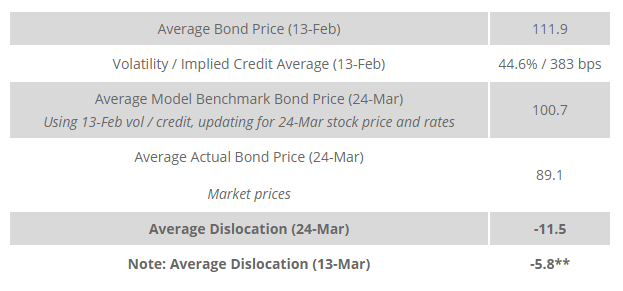

We updated our analysis of secondary market trading levels among recently issued convertibles:

- We examined 32 U.S. convertible bonds issued between August 1, 2019 and February 1, 2020, with deal sizes of $200mm or greater (excluding mortgage REITs which have become a uniquely stressed sector).¹

- We observed market input assumptions as of February 13 (pre Covid-19): (1) stock price, (2) volatility, and (3) rates, and from these inputs and the trading price of each bond, we computed (4) the implied credit spread.

- We then advanced the clock to March 24, and computed what the prices for these bonds would be with consistent volatility / credit spread inputs from February, but applying current stock price and risk-free rate. This generates a benchmark price for where the bonds would be trading in the absence of the currently stressed market.

- We then compare these benchmark prices for the bonds to their actual prices on March 24th. From this, we can deduce the impact of the market stress on convertible bond valuations without needing to parse the individual impacts of credit, volatility and investor demands for “cheapness” in response to current conditions.

Our results are below:

The secondary trading market is currently valuing convertible bonds ~11.5 points lower than pre-Covid-19, a nearly doubling of the impact from a week and a half earlier.

Impact on New Issuance Terms

Once again, we add the final adjustment representing the new issue discount that investors expect, in addition to secondary market cheapening. Given the absence of new issue paper, we continue to assume that investors demand 0.9 points of greater new issue discount to secondary market levels post Covid-19.

From this, we estimate that new issue terms in current conditions require ~12.4 points of additional value for investors versus February. For a 5-year bond, the coupon must be ~3.0% higher for an equivalent conversion premium now (by comparison, we estimated 1.5 – 2.0% as of March 13).

Conclusion

In the absence of new issue data points, our updated analysis implies that prospective issuers in current conditions would expect their coupons to be ~3% higher now than pre-crisis. We will continue to update this analysis as conditions develop.

¹ The issuers were: AERI, AKAM, APLS, AYX (dual tranche), BL, CYBR, ETSY, EVBG, GVA, HALO, IONS, IRWD (dual tranche), JCOM, LITE, MDB, MDRX, NSIT, NVTA, OKTA, PFPT, PODD, PTCT, RH, SAIL, SNAP, W, WGO, WK, Z (dual tranche).