Updated on 3/31/2020 for additional data from algorithm refinement

As social distancing and business closures have taken hold in the last several weeks in response to the developing Covid-19 pandemic, a number of companies are bracing for a downturn by improving their liquidity provisions.

Unfunded revolvers are generally considered to be “rainy day” liquidity, that are almost never drawn. However, there have been news stories throughout March about companies drawing down on their credit facilities. Many drawdowns are in the sectors that are most severely impacted by COVID-19. But, there have also been drawdowns in sectors like technology where the motivation is less the immediate need for the cash than just being safe.

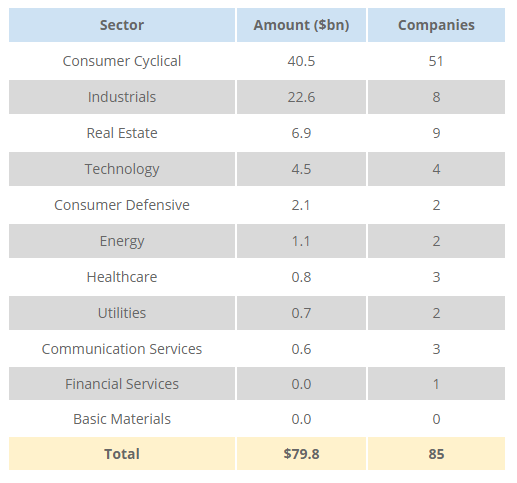

We were interested in quantifying the extent of this highly unusual phenomenon. To do this, we algorithmically scraped all EDGAR 8-K filings, from March 1st to 20th, for announcements of new borrowings under revolving credit facilities. Over this period, we found that 85 U.S. companies borrowed $79.8bn. This contrasts with 62 U.S. companies raising $102.6bn in the investment grade market in the same period.

The table below shows the distribution of the revolver borrowings by industry sectors:

The high proportion of consumer cyclical companies is to be expected. But the data also shows borrowings by many companies in sectors, like technology, that are considered to be less severely affected.

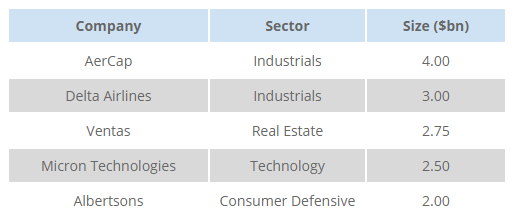

The five largest non-consumer cyclical (and excluding Boeing) borrowings were:

The fact that these companies have also found it advisable to bolster their liquidity position is indicative of the high uncertainty and risk currently perceived by all businesses.