Over the past three weeks, prospective issuers have heard versions of the following banker simplification of the convertible market: “Convertible pricing is very attractive because rates are at historic lows and the benefit from the increased volatility offsets widening credit spreads.” While there is superficial merit to this statement, is this claim empirically true?

In this blog post, we consider whether the convertible market is truly experiencing a goldilocks moment, where despite the significant selloff in the broader markets, issuers can still achieve very low coupons and high conversion premiums.

Simple Model for Comparative Convertible Pricing

The convertible bond market is known for offering companies access to capital in choppy market conditions, relative to the equity and credit markets (especially high-yield bonds). But, it is not always obvious how new-issue terms can change when markets deteriorate. In the past month, volatility has increased and rates have fallen, which theoretically would improve convertible terms; credit has widened, which would worsen them.

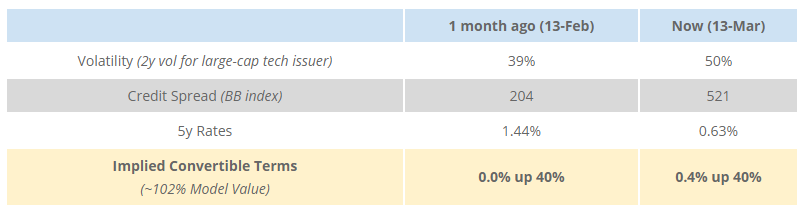

The table below shows where the key input variables for convertible pricing were a month ago (pre COVID-19) and last Friday. Using these inputs, we can calculate the terms of a hypothetical new issue convertible on these two dates.

This analysis implies that the increase in volatility and rally in rates largely offsets the significant widening of credit, resulting in a net worsening of terms by about 40 bps of higher coupon.

Higher Risk Premium

This simple model of measuring the state of the market does not incorporate the important reality that, in times of high uncertainty, investors understandably demand greater risk premiums. When the perception of uncertainty increases, the investor needs a higher margin of error to commit capital.

Specifically, in the convertible market, investors seek additional “cheapness” (i.e., trade at a greater discount to model value) during times of market stress. In addition, market participants often “cap” the volatility input (e.g. at 40 vol) in their pricing models during times of extremely high volatility because these levels are unlikely to persist for the life of the bond.

It is possible to quantify the increased risk premium in the convertible market. We do this by analyzing the secondary market trading in recently issued convertibles:

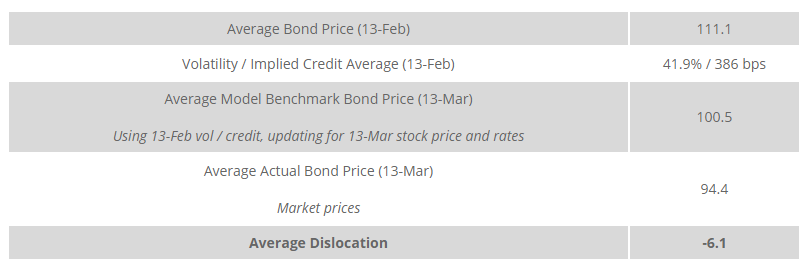

- We examined 35 U.S. convertible bonds issued between August 1, 2019 and February 1, 2020, with deal size of $200mm or greater.¹ We selected these bonds because they have greater liquidity from being issued recently and a maturity profile similar to a new issuance.

- We observed input market assumptions as of February 13 (pre COVID-19): (1) stock price, (2) market-implied options volatility for each issuer, and (3) risk-free rate. Using these inputs and the trading price of each of the bonds on Feb-13, we computed the (4) implied credit spread.

- We then advanced the clock to March 13 (post COVID-19), and computed what the prices for these bonds would be using the same volatility and credit spread from February, but applying the March 13 stock price and risk-free rate. By holding the volatility and credit spread assumptions constant, we can calculate a benchmark price for where the bonds would be trading in the absence of the currently stressed market.

- We then compare these benchmark prices for the bonds to their actual prices on March 13th. From this, we can deduce the impact of the market stress on convertible bond valuations without needing to parse the individual impacts of credit, volatility and investor demands for “cheapness” in response to current conditions.

Our results are below:

The secondary trading market is currently valuing convertible bonds ~6.1 points lower than a month ago.

Impact on New Issuance Terms

Applying the secondary market cheapening impact to new issue pricing requires one additional adjustment: the new issue discount that investors expect. The amount that bonds trade up on day 1 after pricing reflects the gap required by the market between a new issuance “trade” and a secondary market trade. New issues traded up on average ~1.4 points in the second half of 2019. However, new issues in March 2020 traded up 2.3 points² on their first day. This implies that investors demanded 0.9 points of greater new issue discount post COVID-19.

From this, we can estimate that new issue terms in current conditions require ~7.0 points of additional value for investors versus February. For a 5-year bond, the coupon must now be ~1.75% higher for an equivalent conversion premium.

Conclusion

There was no new convertible issuance last week and none expected for this week. In the absence of new issuance data points, our analysis implies that prospective issuers should expect their coupons to be at least 1.5 – 2% higher now than pre-crisis.

We believe that this is a much more realistic assessment of the impact of market stress than the potential conclusion drawn from the initial simple analysis that terms are only marginally worse than in the normalized markets a month ago.

We look forward to updating this analysis as conditions develop, to provide issuers with an objective, data-driven measure of the impact of COVID-19 on the convertible market. You can find more of our commentary on the convertible market on our blog.

¹ The issuers were: ABR, AERI, AKAM, APLS, AYX (dual tranche), BL, CYBR, ETSY, EVBG, GVA, HALO, IONS, IRWD (dual tranche), JCOM, LITE, MDB, MDRX, NSIT, NVTA, OKTA, PFPT, PMT, PODD, PTCT, RH, SAIL, SNAP, W, WGO, WK, Z (dual tranche).

² Excludes Square’s convertible which traded down day 1

Related Articles

Q1 2022 Convertible Market Review

Q2 2022 Convertible Market Review