In a variable maturity ASR, the bank has the right to terminate the ASR on any date that occurs between the specified first acceleration and final termination dates. In return for having this valuable optionality, the bank agrees to provide the issuer with a guaranteed discount to VWAP. Most issuers are well aware of this economic relationship between the variable maturity and VWAP discount.

However, most issuers are unaware that their ASR documentation also gives the bank an additional “lookback” option of quantifiable value. If the issuer is unaware of this option’s existence, it will not understand the economic consequences of granting it to the bank and may not be properly compensated for its value.

The lookback option is created by the notice provision in ASR documentation. Most ASR’s allow the bank to notify the issuer one trading day after its desired end date.¹ While banks’ document templates include this as a standard feature, and issuers thus accept it without question, this feature merits a critical eye.

What is the Lookback Option?

In the guise of an administrative notice provision, the one-day lookback is in fact an economic option, that banks can exercise to their economic advantage. If the stock price falls meaningfully below the average VWAP leading the bank to terminate the ASR, it will use the one-day notice provision to exclude the final (lower priced) day, resulting in a higher average VWAP and repurchase price.

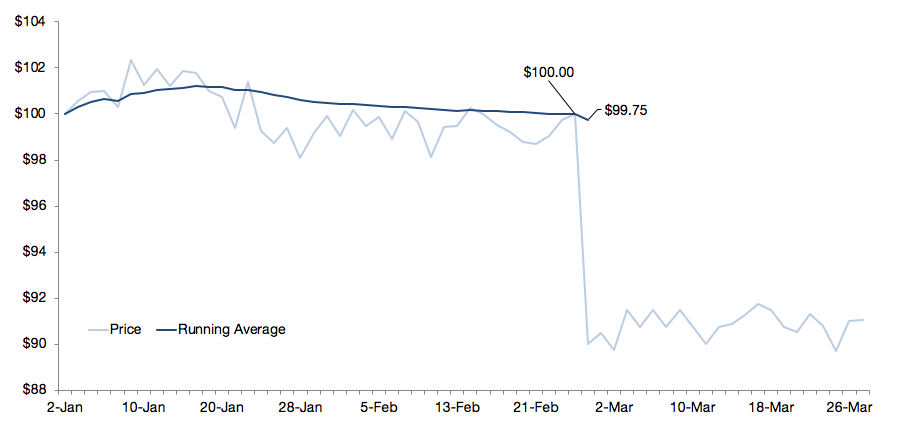

In the example above, the stock price falls 10% ($100 to $90) on the 40th day of an ASR, which will cause the bank to cancel. Without the lookback feature, the average VWAP would incorporate this day, and the average would drop by 0.25%, to $99.75. With the lookback feature, the bank excludes this day from the average VWAP, leaving it at $100.00. This increases the company’s purchase price, and the bank’s PNL, by 25 cents per share. The impact of the lookback depends on how large the stock price move is, and how early it happens in the ASR’s life (eliminating the last trading day out of 20 is twice as impactful as eliminating the last day out of 40).

How Much is the Lookback Option Worth?

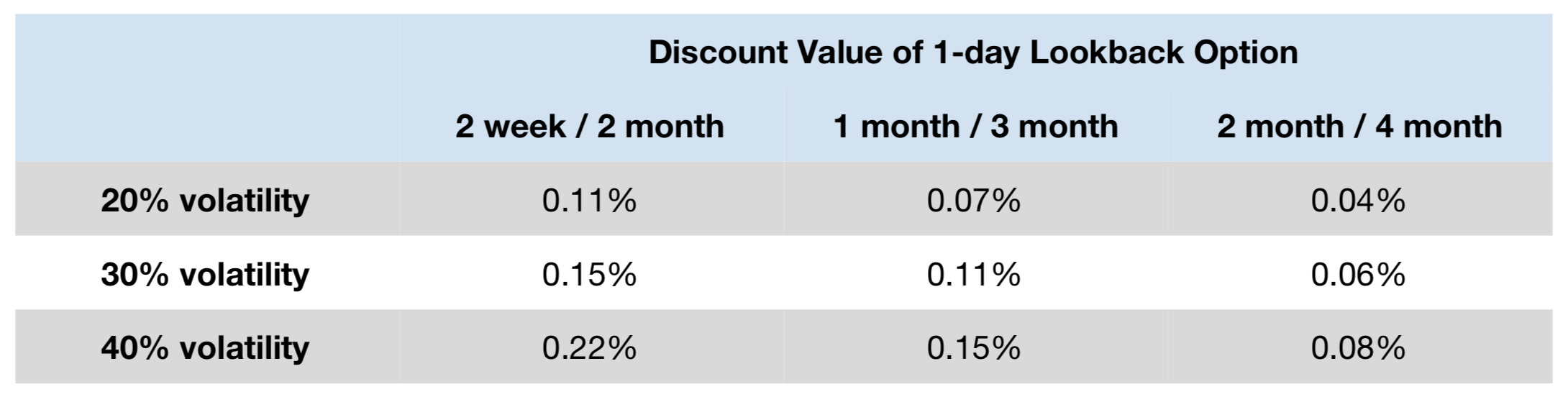

An ASR with the embedded lookback option should have a higher VWAP discount than an ASR without it. The magnitude of the discount differential depends on the structure and volatility. The sensitivity table below shows the additional VWAP discount value from the lookback option for ASRs with varying minimum and maximum variable maturities at three different implied volatility levels.

For ASRs in which two banks alternate days, the impact to discount is somewhat larger, because each bank’s averaging period consists of only half of the days, and each day is therefore twice as important in the average VWAP computation.

Should Issuers Include the Lookback in their ASR?

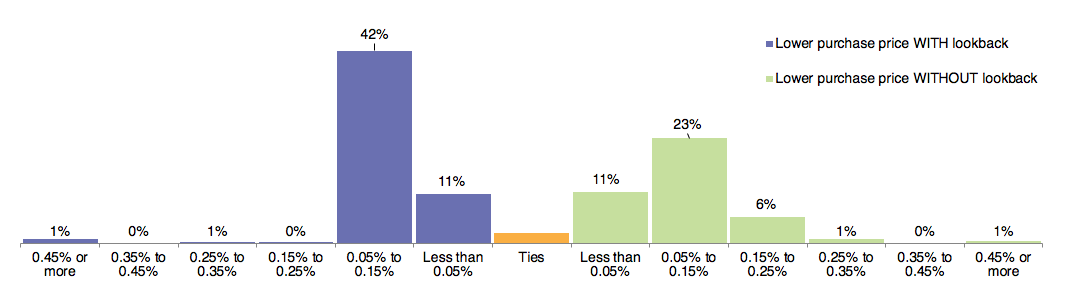

Using the Matthews South ASR software application, we can quantitatively assess whether including the lookback feature is economically advantageous or not. Here, we simulate a 1-month minimum / 3-month maximum ASR with and without a lookback (the with-lookback ASR has an 11 bps higher discount). The structure with the lookback results in a lower repurchase price in ~55% of scenarios, by a fairly consistent 11 bps due to the higher discount. The structure without the lookback results in a lower repurchase price in ~43% of cases, by a more variable amount but on average 15 bps. Across all paths, the expected repurchase price of the two structures is the same.

There are two additional considerations. First: there is stock price directionality to the relative performance of the two structures. The lookback is exercised on early cancellation, which happens when the stock decreases. As a result, the no lookback structure tends to perform better in downward stock price paths. Conversely, the lookback structure performs better in upward stock price paths, where early termination tends not to occur and the issuer benefits from the higher discount.

What About 2 or 3-Day Lookbacks?

Occasionally, ASRs are structured to give the bank the ability to exclude the final two or three trading days in computing the average VWAP and repurchase price. While these structures are even more valuable and thus merit an even higher discount than the one-day lookback structure, they are (counterintuitively) significantly more computationally intensive for models to accurately price. As a result, the banks may need to resort to models that approximate the value of this and other ASR features. This makes it more difficult for an issuer to achieve an efficient price, even in a competitive process.

Conclusion

The decision to include or exclude the lookback option should be an intentional choice, no different that decisions about other ASR parameters like the minimum and maximum maturities. Quantitative analytics can be helpful in making a choice. We recommend that issuers first quantify the value of the lookback option to understand the VWAP discount benefit. Next, Monte Carlo simulations and historical backtesting, can help quantify the risk incurred to gain the additional discount to make an informed decision. Our software application allows us to provide the output of both steps quickly and easily.

¹ Typical language is: “Dealer shall have the right to designate any Calculation Date on or after the First Acceleration Date to be the Termination Date (the “Accelerated Termination Date”) by delivering notice to Counterparty of any such designation prior to 11:59 p.m. New York City time on the Calculation Date immediately following the designated Accelerated Termination Date (the “Accelerated Termination Notice Date”).”