An attractive feature of ASRs is the upfront share delivery. The immediate retirement of shares provides greater EPS improvement than an equivalent amount of open market share repurchases. The delivery also significantly reduces the credit exposure to the bank that is created by the pre-payment of the ASR contract.

There are no legal, contractual or accounting requirements for a specific amount of upfront share delivery. And yet, almost every ASR is executed with 80% upfront delivery.

This may either be a rare instance of one-size truly fitting all or a generally missed opportunity to optimize ASR structuring.

Consideration for Setting Proper Upfront Delivery

The EPS and credit exposure benefits from taking more shares upfront have to be balanced against the risk of owing value to the bank at the settlement of the ASR. Owing value at final settlement means that the issuer faces the choice of cash or share settling the obligation. Cash settling is easier but can create future accounting issues. Share settlement is best for accounting purposes but burdensome to execute because it entails either a registered offering or private placement to the bank.

Setting the proper upfront delivery therefore should be a careful weighing of the EPS/credit exposure benefit against the probability of owing value for a given delivery amount. The latter is a function of the length of the ASR and volatility of the stock. The longer an ASR, the greater the opportunity for the stock to rise meaningfully. Similarly, more volatile stocks have a higher chance of meaningful appreciation.

ASRs are executed with various maturities and stocks have different volatilities. As a result, the likelihood of owing value is different in each ASR. Applying a universal 80% upfront delivery to every ASR must mean that it may be conversative in some instances and aggressive in others.

What is the appropriate upfront share delivery?

The upfront share delivery amount should be the output of how much risk an issuer wants to take on owing value.

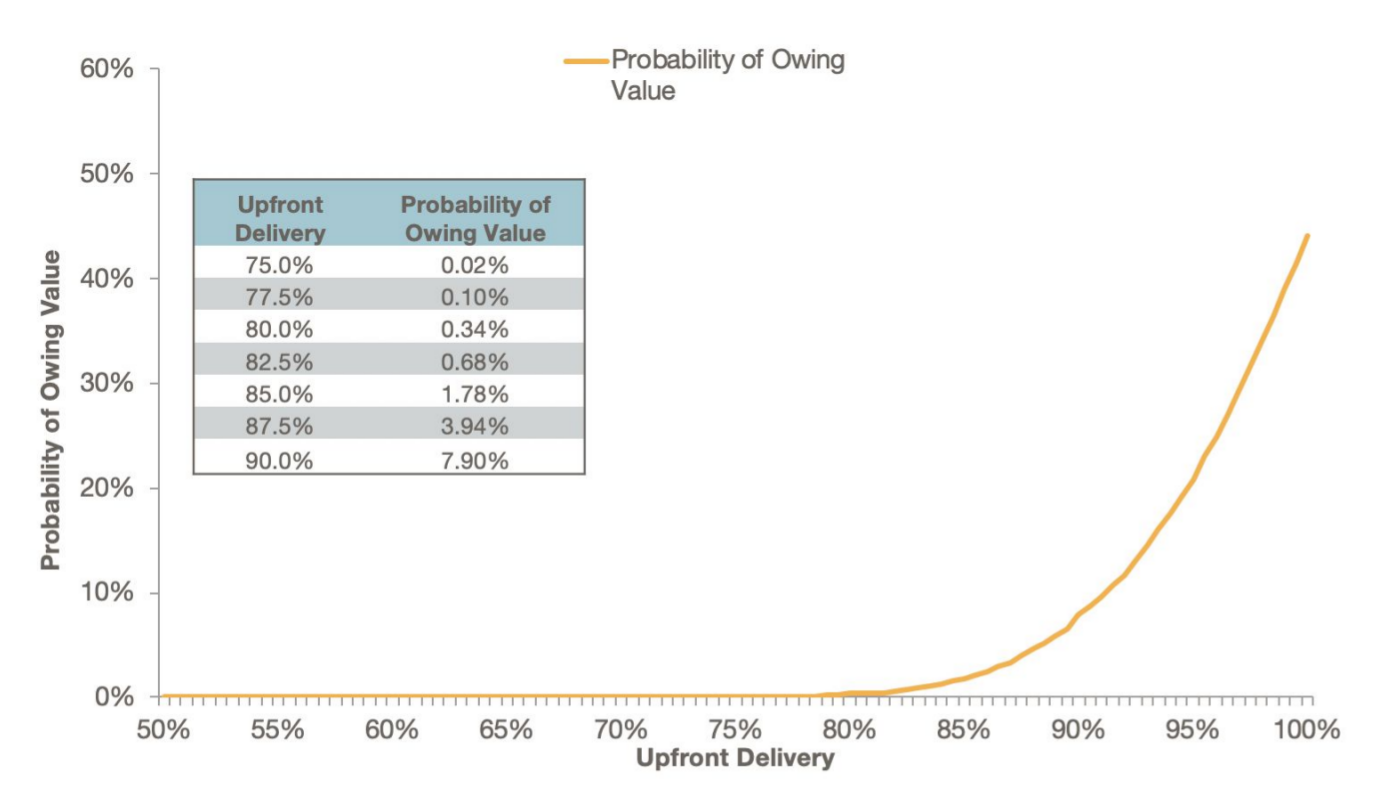

To quantify this risk, we run a Monte Carlo analysis to calculate the probability of owing value. We generate 5,000 paths using the company’s options implied volatility. We simulate the ASR on each path. We can see how many paths resulted in the company owing value, which allows us to calculate the probability of owing value.

Let’s consider a 30% volatility issuer that is evaluating a three month ASR. Its probability of owing value for 80% upfront share delivery is 0.34% (1 in ~300). Let’s say the issuer is comfortable with a 1 in 100 chance of owing value. Using the probability curve below, they could move up to ~83.5% upfront delivery.

Let’s say the same issuer decided to do a six month ASR instead. In a six month ASR, the stock has more time to appreciate and introduces a greater chance that the company owes value. Solving for the same 1% chance of owing value, the company should use 77% upfront share delivery.

This example illustrates the problem with always using 80%. For an issuer (with a 30-vol stock) that is comfortable with a 1% chance of owing value, 80% is too conservative for a three month ASR and too aggressive for a six month ASR.

Contrary to the general market practice, we believe that the upfront delivery should be calculated for each ASR based on the issuer’s risk tolerance, the terms of that ASR, and current volatility of the stock.